TL;DR

- You can earn yield on ETH through staking, liquidity provision, or lending.

- Liquidium is a user-friendly, non-custodial, and cross-chain DeFi lending platform that allows anyone to earn interest on their ETH by connecting their wallet and supplying their tokens into its lending pool.

Can You (Really) Earn Interest on Ethereum?

Yes, you can earn interest on your ETH holdings.

ETH doesn’t generate interest on its own when it sits in your wallet.

Tokens don’t pay interest natively when you’re just holding them in your wallet, unlike the money held in your bank account.

But it can earn yield if you lend it out to traders and investors that need liquidity.

If you want your ETH to work for you (in other words, if you want to earn interest on it),

you can supply it in a lending pool on a DeFi lending protocol like Liquidium.

3 Ways to Earn Interest on Your ETH

There are several ways you can earn yield on your ETH.nHere are the most common:

Staking

Staking ethereum involves locking some of it in a smart contract to provide validator services on the blockchain. In return, you earn rewards in ETH for helping to secure and maintain the network.

That said, solo staking requires meeting a significant 32 ETH participation requirement.

Meanwhile, delegated staking for less ETH exposes you to third-party platform risks.

Liquidity Provision

Providing liquidity in the DeFi market involves depositing ETH into exchange liquidity pools.

In return, you earn a share of trading fees and sometimes additional liquidity provider (LP) rewards, which are typically paid in platform tokens.

While the returns can be attractive, liquidity provision is more complex than DeFi lending and carries potential risks such as impermanent loss.

Lending Protocols

Lending is one of the simplest and most accessible ways in DeFi to generate income from your unused ETH.

With cross-chain lending protocols like Liquidium, you can supply your ETH to a lending pool that other users borrow from.

In return, you earn interest while your funds remain under your control.

Step-by-Step Guide: How to Earn Interest on ETH Using Liquidium

Here’s how to begin earning interest using your ETH on Liquidium:

Go to the Liquidium Website

Navigate to Liquidium’s official website at https://liquidium.fi.

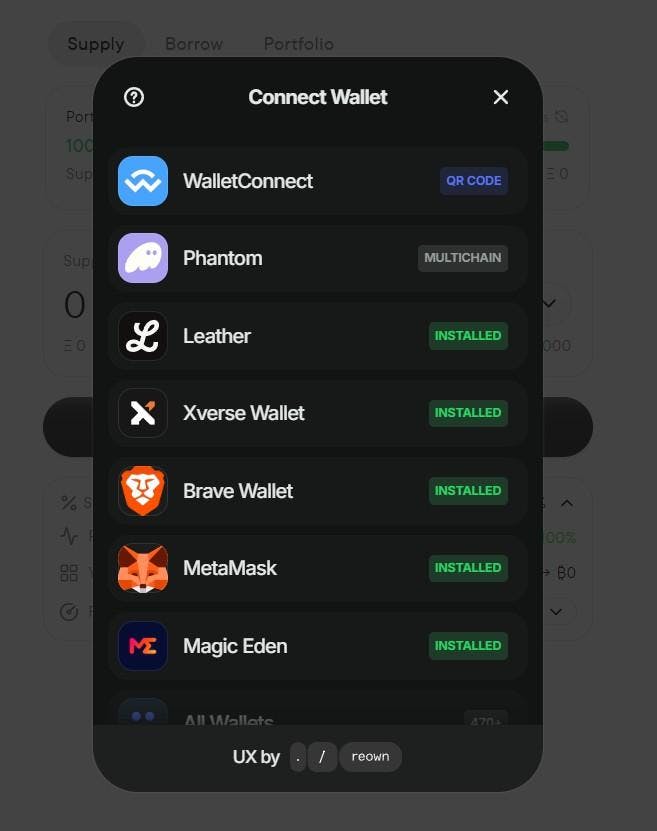

Connect a Compatible Wallet

Click on the ‘Sign in’ button and choose your Ethereum wallet. Liquidium supports a wide selection of crypto wallets.

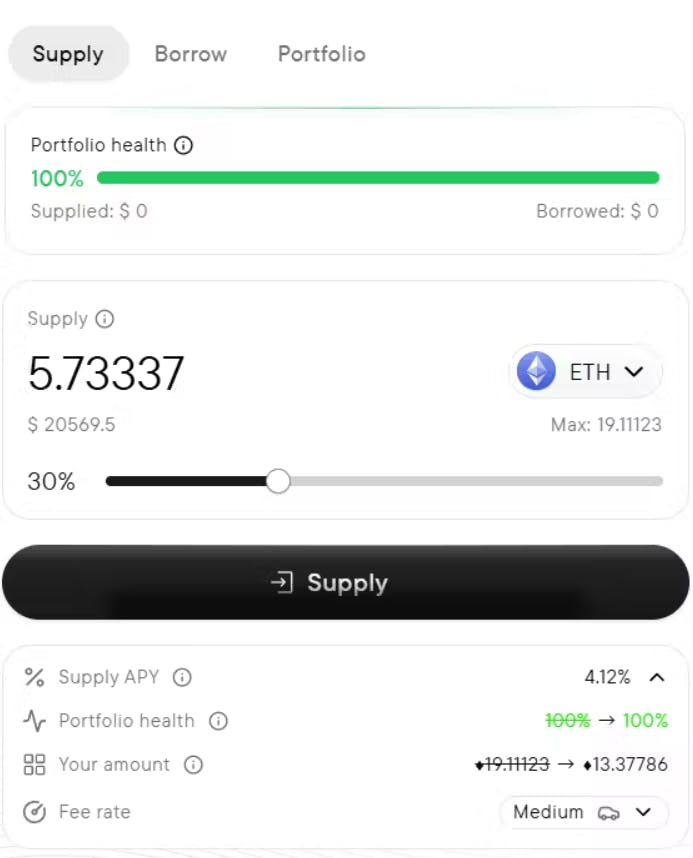

Deposit Your ETH

Under the ‘Supply’ tab, choose ETH, select the amount you want to lend, click on the ‘Supply’ button,

and approve the transaction in your wallet.

Your assets are now supplied to the lending pool and made available to borrowers.

Start Earning Interest

As borrowers draw the resources supplied in the lending pool, you’ll earn interest.

Liquidium uses a self-balancing dynamic interest rate model based on supply and demand.

This means that APY adjusts in real time with pool utilization.

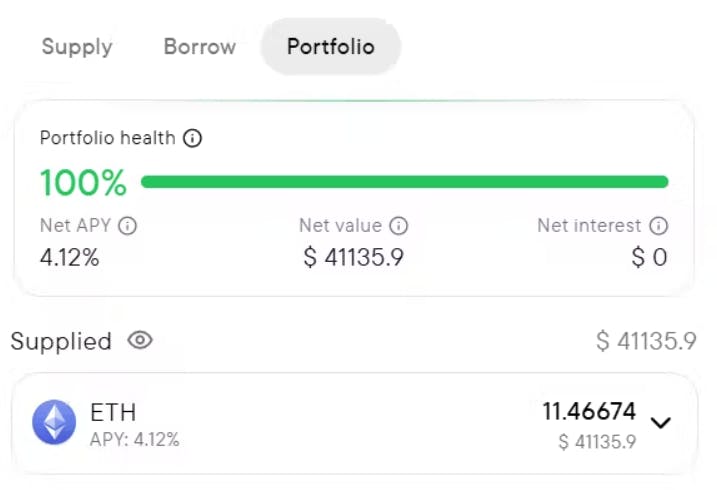

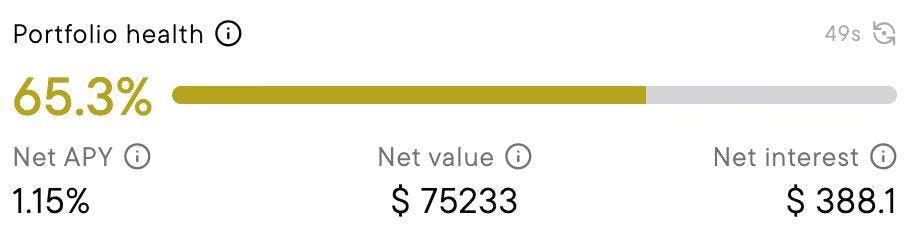

Track Your Earnings & Manage Your Portfolio

The entire procedure is completely transparent through on-chain data.

You can view your earnings, total loan volume, and platform stats right from your Liquidium dashboard.

Why Choose Liquidium to Earn Interest on ETH?

Choosing Liquidium to lend ETH is arguably the best way to earn interest on Ethereum. The platform is designed to be secure and user-friendly. As such, it supports earning yield on your assets on a clean interface in just a few simple steps.

Loans are over-collateralized and monitored via LTV. If thresholds are breached, automated liquidations occur.

Additionally, the platform is cross-chain, which means that borrowers across Ethereum, Solana, and other blockchains can access liquidity, and lenders can respond to its demand.

Finally, Liquidium’s lending platform is fully non-custodial, with smart contracts powered by Chain Fusion and anchored to Bitcoin, Ethereum and Solana L1, relying on its security.

“We want ETH holders to earn real, native yield without detours like wrapping or manual bridges. With Liquidium, you can supply ETH directly, retain custody of your funds, and meet cross-chain demand with dynamically adjusted rates,” explains Robin Obermaier, Liquidium co-founder & CEO.

Lend Your ETH & Start Earning Interest on Liquidium

If you’re on the lookout for the best place to earn interest on ETH, you’re in good hands with Liquidium.

Thanks to its unique cross-chain lending capabilities, high-level security, and growing community of borrowers and lenders, the platform makes ETH lending easily accessible and straightforward, even for beginners.

Put your ETH to work and start earning interest securely and effortlessly with Liquidium.

Disclaimer: This article does not constitute financial advice, and we strongly recommend conducting your own research and consulting with a professional financial advisor before making any investment decisions.

We are not liable for any potential losses incurred from applying the strategies discussed. Proceed with caution and at your own risk.

FAQs

What is the best place to earn interest on Ethereum?

The best place to earn interest on Ethereum depends on your priorities, primarily in terms of security, yield potential, and ease of use.

Liquidium is a great choice thanks to its transparent lending system, non-custodial design, cross-chain support, and simple user interface. This allows ETH holders to earn interest with full transparency and zero friction.

Which is the best way to earn interest on Ethereum?

The best way to earn interest on ETH is arguably through DeFi lending, where you deposit your ETH into a lending pool.

DeFi lending platforms like Liquidium connect your capital with borrowers who seek liquidity, allowing you to earn interest as a lender.

This yield-generation approach is especially popular among users looking for low-volatility income without having to sell their assets.

Where can I earn interest on Ethereum?

There are a few decentralized applications (dApps), including Liquidium, that allow you to earn interest on your ETH by lending it to borrowers across different chains.

These platforms facilitate peer-to-peer lending using smart contracts, letting you earn interest while you maintain control over your funds.