TL;DR

- Cross-chain lending lets users borrow assets on one chain using collateral on another.

- Liquidium.fi enables secure cross-chain lending using BTC as native collateral for loans on other platforms.

What Is Cross-Chain Lending?

Cross-chain lending is a DeFi service that lets users deposit collateral on one blockchain and borrow a different asset against it on another blockchain. This allows users to access liquidity across blockchains, providing a highly flexible DeFi borrowing and lending option.

Lending is one of the largest sectors of DeFi, with over $50 billion total value locked (TVL) across multiple chains according to data aggregator Defillama.

But until the launch of Liquidium.fi, true cross-chain lending hasn’t been an option.

Now, you can use your native bitcoin as collateral to borrow stablecoins or other tokens, without needing to wrap or bridge your BTC yourself.

How Does a Cross-Chain Lending Protocol Work?

To explain how cross-chain lending works, we will use LiquidiumFi, the only true cross-chain DeFi lending protocol, as an example.

LiquidumFi uses a pooled lending model, which allows you to deposit funds into shared pools for various asset types. You can then borrow from these pools using any major Layer 1 asset (such as BTC or ETH) as collateral, even if they are on different chains.

All loans are over-collateralized to manage risk, which means borrowers deposit more value than they borrow.

The platform's cross-chain functionality is powered by Internet Computer Protocol (ICP) in the backend.

ICP acts as the decentralized infrastructure that enables seamless communication between multiple Layer 1 blockchains without you needing to manually bridge tokens.

When you deposit an asset, it is converted into a Chain-Key (CK) asset on ICP (for example, ckBTC or ckUSDT). This creates a unified environment for internal operations and ensures speed, efficiency, and rollback protection. And unlike centralized bridges, this provides a first-of-a-kind, fully decentralized solution.

As the user, you experience a seamless flow, depositing native assets and receiving them back when you withdraw them.

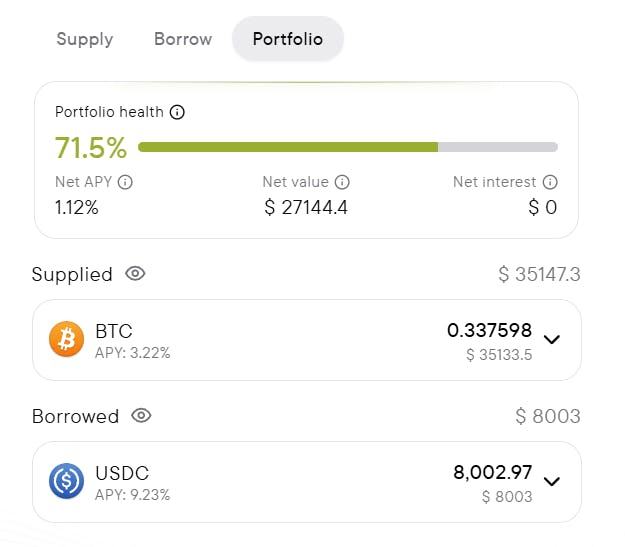

Your lending portfolio's health is continuously monitored through Loan-to-Value (LTV) ratios. If your LTV ratio approaches dangerous levels, a decentralized liquidation engine activates.

The platform uses ICP's decentralized price oracle for accurate asset pricing, which aggregates price data from major exchanges, to provide real-time valuation of lending collateral assets and to help trigger automated liquidations when the loan-to-value (LTV) thresholds are breached.

Liquidium also uses a dynamic interest rate model that automatically adjusts based on supply and demand to maintain optimal pool utilization and liquidity.

The Cross-Chain Lending Process Flow Explained

To better understand how cross-chain lending works, here’s an overview of the process on Liquidium.fi using BTC as collateral to borrow stablecoins, USDT or USDC.

- You deposit BTC & they are converted on ICP: You start by linking your Bitcoin wallet on Liquidium.fi and send your bitcoin to our protocol through ICP.

- Loan is issued: Once your collateral is live on ICP as ckBTC, you can request to borrow assets, such as the stablecoins USDC or USDT. The funds are then drawn from lending pools and released to your connected wallet on the chosen target blockchain, such as Ethereum or Solana.

- Collateral is monitored: Liquidium continuously monitors each portfolio’s health via Loan-to-Value (LTV) ratios and ICP’s decentralized oracles.

If your BTC collateral value drops and crosses a preset liquidation threshold, a percentage of your collateral is automatically liquidated, with proceeds used to repay the loan.

This ensures the platform maintains solvency and minimizes risk to lenders.

- Repay the loan: When you’re ready, pay back the borrowed amount (plus interest). Cross-chain loans on Liquidium are perpetual, so you can repay any time, and it doesn’t have to be the full amount in one go.

- Your BTC collateral gets returned: If you want to withdraw your funds, your ckBTC is converted back into native BTC and returned directly to your original Bitcoin wallet.

Why Use Bitcoin as Collateral in Cross-Chain Lending?

There are many reasons why BTC is an ideal collateral asset to borrow against in cross-chain lending. The most notable ones include:

- Non-custodial nature: You maintain control of your BTC at all times through decentralized smart contracts. You never hand the asset over to a centralized entity.

- Upside exposure: Borrow against your BTC without selling it, so you can stay long bitcoin and gain liquidity.

- Access to DeFi ecosystems: Obtain yield, liquidity, and opportunities on Ethereum, Solana, and other networks.

- Productive use of BTC: Put your holdings to earn yield instead of leaving them sitting in your wallet.

“Liquidium was built to give Bitcoin real utility in DeFi without the compromises of wrapping or centralization.

This is true Bitcoin-native borrowing and lending, and it’s just the beginning,” says Liquidum CEO Robin Obermaier.

How to Use Bitcoin as Collateral to Borrow Across Chains on Liquidium

Borrowing assets using your BTC through Liquidium is simple and straightforward, even for a beginner. Here’s how it works, step by step.:

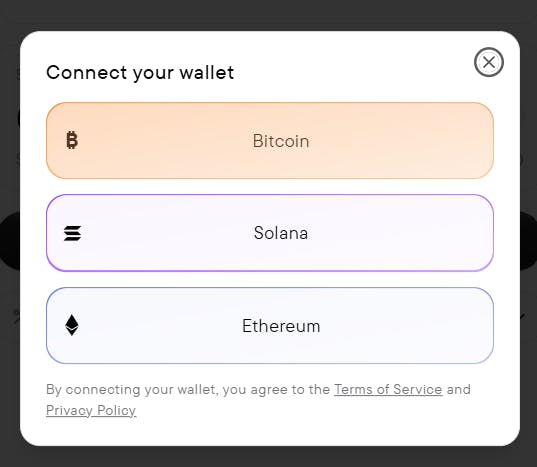

Visit Liquidium.fi and connect your Bitcoin wallet.

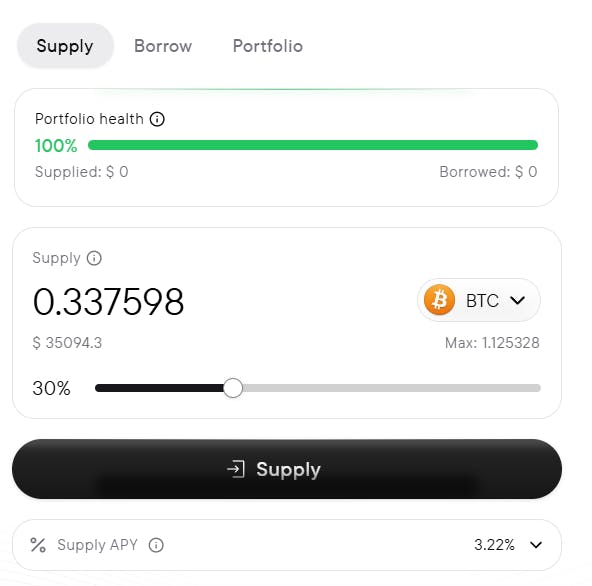

Supply BTC into the protocol through the ‘Supply’ tab.

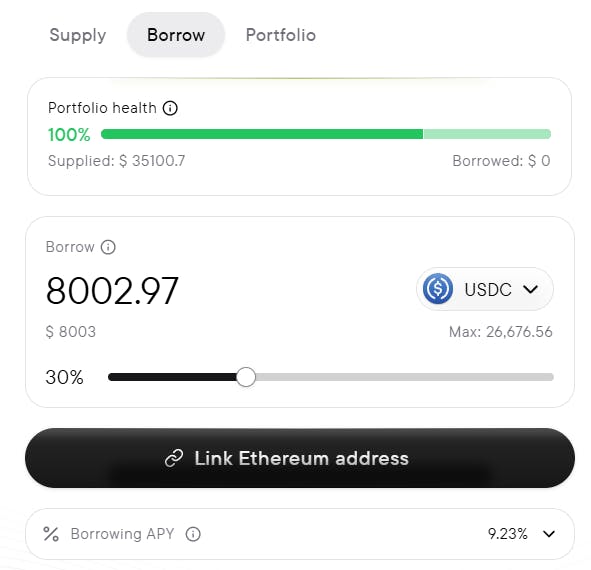

Under the ‘Borrow’ tab, choose your loan asset on the destination chain,

such as USDC any available tokens on Ethereum or Solana, and link your wallet on the destination chain (e.g., MetaMask).

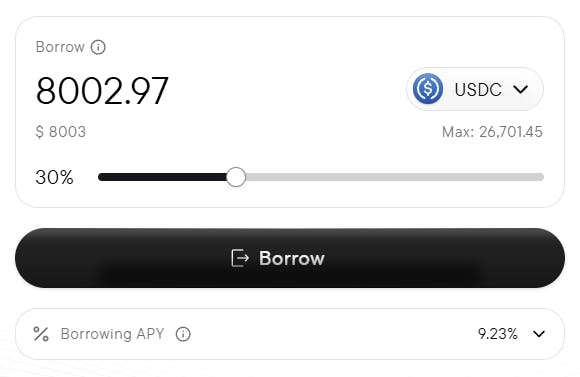

Confirm terms like interest rate, duration, and collateral ratio, and select the ‘Borrow’ button.

Initiate the lending process.

Once your BTC is deposited and represented as ckBTC on ICP, you’ll receive the borrowed tokens in your other wallet.

Check your history under the ‘Portfolio’ tab.

And that’s it! You’re now borrowing against your bitcoin across blockchains.

Benefits & Limitations of Cross-Chain Lending on

Liquidium

Though cross-chain lending opens up powerful new DeFi use cases for bitcoin HODLers,

it’s important to weigh the advantages against the potential downsides before using the protocol.

Pros

- Native BTC collateral

- DeFi opportunities on multiple chains

- Permissionless and decentralized

Cons

- Borrowing requires some knowledge of maintaining a positive portfolio health

Borrow and Lend Across Chains on Liquidium

With Liquidium’s cross-chain lending protocol, users can borrow and lend with only a few clicks. This includes borrowing and lending across Bitcoin, Ethereum, and Solana. The process uses native assets with ICP Chain-Key bridging, so there’s no need for wrapping or custodians.

Connect your wallet to Liquidium.fi to explore true cross-chain lending.

Disclaimer: This article does not constitute financial advice, and we strongly recommend conducting your own research and consulting with a professional financial advisor before making any investment decisions.

We are not liable for any potential losses incurred from applying the strategies discussed. Proceed with caution and at your own risk.

FAQs

Can Bitcoin be used as collateral for a loan?

Yes, bitcoin can be used as collateral on cross-chain lending protocols like Liquidium.fi. There, your BTC is deposited into a secure vault and represented as ckBTC on the Internet Computer Protocol (ICP).

You can then borrow assets from another blockchain against your BTC without wrapping or having to give up custody of your BTC.

How secure are cross‑chain lending protocols?

Cross-chain lending relies on a system of secure bridges, smart contracts, and oracles to maintain protocol integrity.

Platforms like Liquidium.fi minimize trust assumptions and reduce attack potential.