TL:DR

- Lending USDT is a way to earn income by providing your stablecoins to borrowers.

- USDT lending rates vary by platform, market demand, and loan terms.

- Liquidium makes it easy to lend USDT in a non-custodial and decentralized way.

What is USDT?

Tether USD (USDT) is one of the most popular stablecoins in the crypto market. The price-stable digital currency is pegged to the U.S. Dollar at a ratio of 1:1, backed by U.S. dollars and near-cash dollar-denominated assets.

USDT is mainly used as trading capital, as a base currency for trading pairs, and as a lending asset, all due to its relative price stability.

How Does USDT Lending Work?

USDT lending involves three primary participants: the lender, who provides USDT and earns interest on it, the borrower, who takes the USDT as a loan and locks up their crypto as collateral, and finally, the lending platform that brings together borrowers and lenders, handles collateral, and automates the lending transaction.

Typically, the process goes like this:

- A lender supplies USDT to a lending pool.

- A borrower provides collateral that exceeds the loan value (overcollateralization).

- The borrower received the USDT, and their collateral is locked by a smart contract.

- The borrower repays the loan (plus interest), and the collateral is released back to them.

- Failure to repay the loan leads to automatic liquidation and settlement of the loan.

How Do USDT Lending Rates Work?

Interest rates in USDT lending may differ across platforms and are determined by various factors. These include demand for loans, platform type, and whether you choose fixed or flexible lending terms.

Here’s how it all works:

- Supply and demand for USDT: If many people want to borrow USDT, lending rates may go up. When the demand goes down, the rates drop.

- The chosen USDT lending platform: CeFi platforms often have fixed rates, whereas DeFi rates are variable or dynamic.

- Loan duration (fixed vs. flexible terms): Longer or fixed-duration loans can offer higher returns compared to shorter and more dynamic ones.

Fixed vs. Variable Rates

Fixed Rates

Pros:

- Predictable, stable income

- Great for long-term planning

Cons:

- Might miss out on higher variable yields

- Funds are often locked for a set period

Variable Rates

Pros:

- In line with current market demand

- Potential for higher returns when rates rise

- Flexible withdrawal (on some platforms)

Cons:

- Earnings may go up and down

- Can drop suddenly in low-demand environements

“Stablecoin lending adds to the core principles of decentralized finance. It empowers users with financial control without compromising their autonomy. Liquidium is designed to facilitate that,” says Robin Obermaier, CEO & Co-Founder of Liquidium

Types of USDT Lending Platforms

There are two main options for lending USDT: centralized (CeFi) and decentralized (DeFi) lending platforms. Understanding the difference is key to making an informed choice.

Centralized Finance (CeFi) Platforms

Centralized lending platforms are apps built and managed by companies that custody your funds and manage the lending process. Examples include Binance Loans. Advantages of these platforms include user-friendliness and (usually) fixed rates.

However, to use them, you must trust the corporate entity with your funds, as they get full control over them. You have to accept the risk of a potential collapse (like what has happened with Celsius and a couple of other centralized lending platforms).

Decentralized Finance (DeFi) Platforms

DeFi lending apps are on-chain protocols like Liquidium. They use smart contracts to automate the lending process.

As opposed to CeFi, DeFi platforms let you retain full control of your assets and provide transparent rates and mechanisms. They are also accessible to anyone, anywhere, and at any time.

Benefits of Lending USDT

Like any investment product, USDT lending comes with both the good and the bad. Let’s look at both to help you decide if it works for your crypto strategy.

- Earn income on idle assets

- Access to competitive yields

- Wide range of platforms and lending terms

- Easy to integrate into DeFi strategies

How to Lend USDT on Liquidium to Earn Yield, Step-by-Step

Now, let’s take a look at how you can lend USDT on Liquidium with just a few clicks.

Visit Liquidium

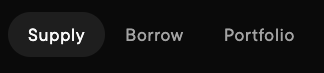

Go to liquidium.fi and click on the ‘Supply’ tab.

Select the USDT market

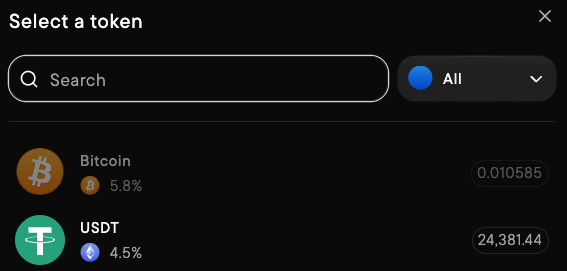

Choose USDT from the list of supported tokens.

Connect your wallet

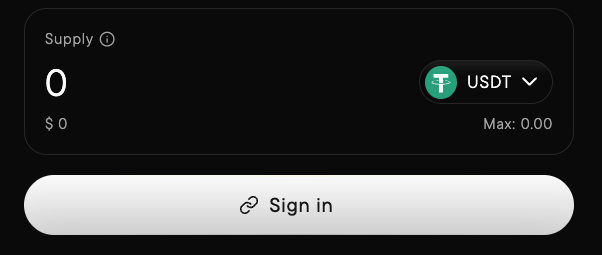

The platform will ask you to connect your wallet (like MetaMask).

Deposit USDT

Choose how much USDT you wish to lend, verify the terms, click on the ‘Supply’ button, and confirm the transaction in your wallet.

The deposit will then be initiated and completed.

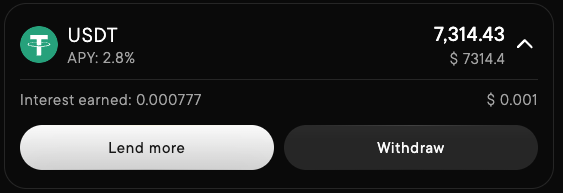

You can manage your loan under the ‘Portfolio’ tab in the app.

Lend Your USDT & Earn a Yield on Liquidium

Lending your USDT is arguably one of the easiest ways to grow your digital asset portfolio.

Liquidium, a non-custodial, cross-chain lending protocol, makes the process easy, secure, and transparent.

FAQs

How can I lend USDT?

You can lend USDT by depositing your stablecoins either on a centralized or a decentralized lending platform and start earning yield. The exact process will differ from platform to platform, but payouts are usually daily.

Is lending USDT better than staking?

It depends on your goals, as lending and staking are different strategies. Lending USDT earns interest from borrowers, whereas staking usually involves reaping rewards from network participation. Lending is ideal for stablecoins like USDT if you want to earn relatively stable interest, while staking cryptocurrencies (such as ETH and SOL) comes with more market volatility. Staking may also include lock-up periods, and there’s the risk of staking rewards slashing.

How to choose the best USDT lending platform?

Look for platforms with a strong reputation, high liquidity, and competitive rates. Decide whether you prefer full custody (DeFi) or convenience (CeFi). Liquidium is ideal for users who seek transparency, decentralization, and the ability to earn yield on native bitcoin.