TL;DR

- Borrowing against Bitcoin gives you access to liquidity without having to sell your BTC.

- Liquidium.fi equips you with a non-custodial way to borrow stablecoins using your BTC as collateral.

- Your BTC stays secure on-chain, and you receive your stablecoin loan on a supported blockchain.

Why Do People Borrow Against Their Bitcoin?

There are quite a few compelling reasons why crypto investors are using BTC as collateral to borrow against. Among the most important ones are:

- Instant access to liquidity: You can use your BTC to borrow stablecoins (or other tokens) for DeFi purposes like trading, yield farming, real-world expenses, or anything else you might need them for.

- Upside exposure: You can borrow stablecoins against your Bitcoin assets without selling BTC, so you can stay long on your bitcoin holdings as you gain the liquidity you need in other assets.

- Tax reasons: As you don’t sell your BTC, you don’t need to pay the capital gain tax.

- Productive use of idle BTC: Idle BTC in your wallet? Put it into a liquidity pool and start earning passive yield—no need to let it sit unused.

Should You Use CeFi or DeFi Platforms When You Borrow Against Your BTC?

If you’re looking for a more trustless, transparent, and non-custodial way to borrow against your BTC, DeFi platforms are your place to go.

CeFi platforms are custodial. You deposit BTC to their wallet, and they manage your funds as they provide you with a loan. This demands trust in the platform’s solvency and integrity–risks that have been made evident through several well-publicized collapses over the years.

DeFi platforms like Liquidium are non-custodial. You retain full control of your BTC holdings at all times, thanks to smart contracts that help get your loan quickly and safely (without having to deposit your coins with a third party).

"Liquidium was built to empower Bitcoin holders to access DeFi without compromise–your keys, your coins, your collateral, and across chains," explains Robin Obermaier, the co-founder and CEO of Liquidium.

How Do You Borrow Against Your Bitcoin?

Borrowing against BTC involves locking it up as collateral and receiving a loan in another asset, often a stablecoin.

How much you can borrow depends on the loan-to-value (LTV) ratio, and, of course, how much BTC you want to use as collateral. For example, at an LTV of 80%, you can borrow up to $800 in stablecoins for every $1,000 in BTC you put up as collateral.

Liquidium.fi supports BTC as collateral for loans, and once your coins are locked up in a smart contract, you can get your loan in Solana or Ethereum-powered assets without having to wrap your coins or trust a third-party custodian.

Taking out a loan in stablecoins like USDT or USDC against BTC as collateral is prevalent, as they offer you high liquidity and extensive utility. This makes them ideal for borrowing against long-term holdings, such as Bitcoin.

How to Borrow Against Your Bitcoin on Liquidium, Step-by-Step

Borrowing assets using your BTC as collateral through LiquidiumFi is straightforward, even if you’re a novice when it comes to DeFi loans.

Here’s a step-by-step walkthrough for the entire process:

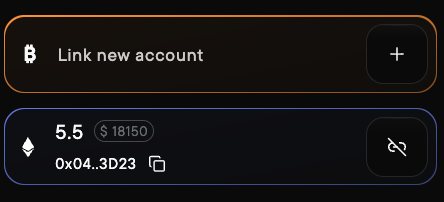

Visit Liquidium.fi and connect your wallet.

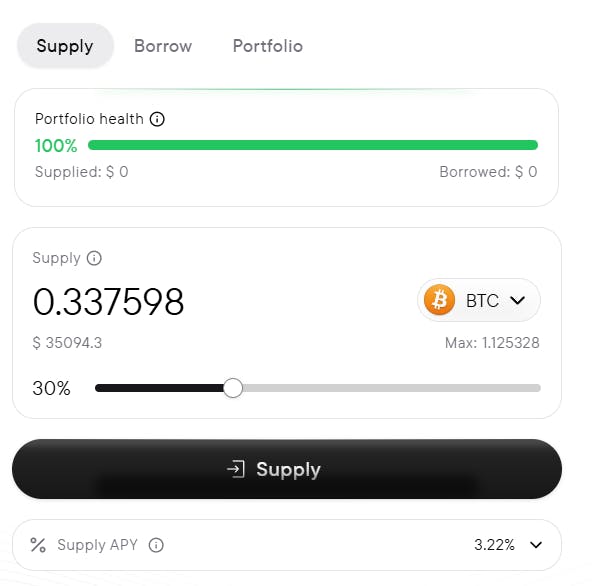

Under the ‘Supply’ tab, deposit BTC.

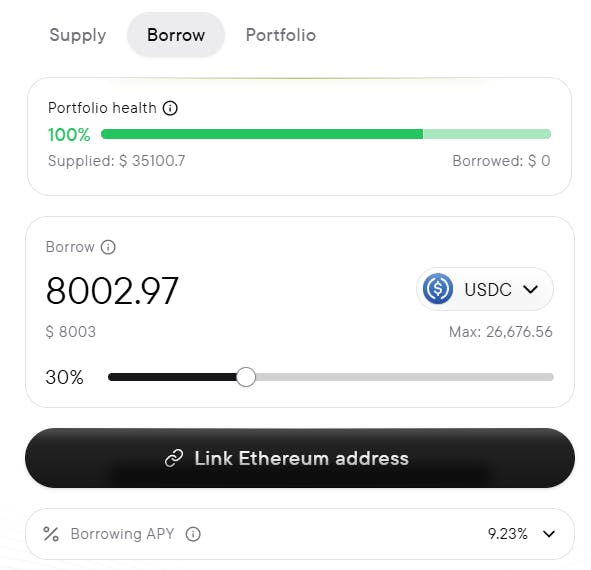

Choose your loan asset on the destination chain, such as USDC on Ethereum or USDT on Solana, under the ‘Borrow’ tab.

Link your Ethereum or Solana address where you want to receive your loan.

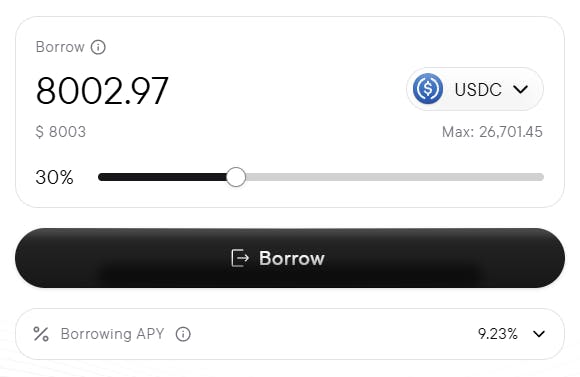

Check the terms like interest rate, duration, and collateral ratio, and select the ‘Borrow’ button.

Start the loan. After your BTC gets locked and the confirmation message is verified,

you’ll receive the borrowed tokens in the Ethereum or Solana address you linked earlier.

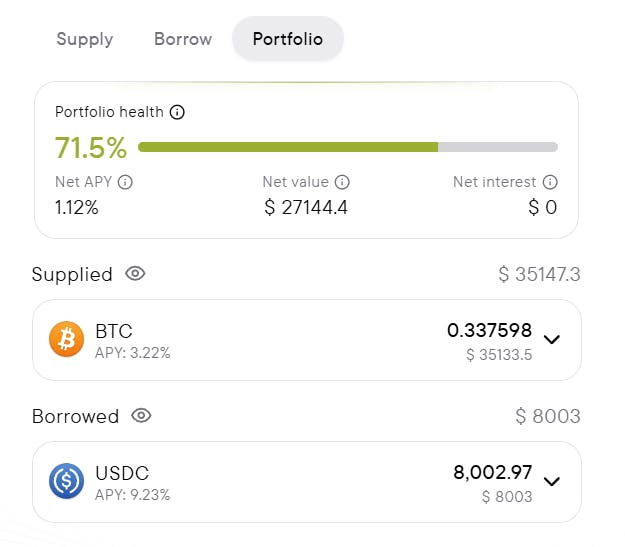

You can check your borrowing history and supply under the ‘Portfolio’ tab.

Benefits of Bitcoin-Backed Loans

Here’s a quick breakdown of the benefits of BTC-collateralized borrowing:

- Access to liquidity without selling Bitcoin

- Ability to use borrowed funds for other profitable investments

- No capital gains tax event as you do not sell your Bitcoin

- Upside exposure

- In DeFi, your collateral is locked by a smart contract, not a centralized party

Borrow Against Your Bitcoin & Earn Yield on Liquidium

Beyond just borrowing stablecoins such as USDT and USDC against your Bitcoin, Liquidium also allows you to earn yield on your BTC by supplying it to the lending pool. So, if you’re not looking to borrow funds right now, you can still put your BTC to work and earn interest passively.

Connect your wallet to Liquidium.fi and use your BTC to borrow beyond borders.

Disclaimer: This article does not constitute financial advice, and we strongly recommend conducting your own research and consulting with a professional financial advisor before making any investment decisions. We are not liable for any potential losses incurred from applying the strategies discussed. Proceed with caution and at your own risk.

FAQs

Can I take out a loan against my Bitcoin?

Yes, you can use your Bitcoin as collateral to take out a loan through platforms like LiquidiumFi. Your BTC is securely locked by the protocol. Once locked, you can receive a loan in stablecoins or ETH and repay it later to take back your BTC.

How do you borrow money against your Bitcoin?

To borrow money against your BTC, you deposit your collateral into a lending protocol like LiquidiumFi. Based on the deposited BTC value and the LTV ratio, you’ll receive a loan in stablecoins like USDC or USDT or ETH. The loan remains active as long as your collateral maintains its value above the minimum threshold, which is monitored in real time.

Is borrowing against your Bitcoin safe?

Borrowing against your Bitcoin is safe, provided you’re using an audited protocol like LiquidiumFi. With it, your BTC will remain on the base layer, controlled by transparent smart contracts, not centralized custodians, which already removes the risks involved with CeFi platforms. At the same time, you’re getting liquidity in a different token, even on a different blockchain.

Can you borrow against your Bitcoin without selling it?

Absolutely. Thanks to platforms like Liquidium.fi, you can easily borrow other assets against your Bitcoin holdings without having to sell them. They stay fully in your control, secured by smart contracts. The most popular assets to borrow with BTC as collateral are stablecoins like USDC and USDT, as they provide high liquidity, low volatility, and various use cases.