TL;DR

- DeFi lending enables peer-to-peer crypto loans without intermediaries by using smart contracts on blockchains.

- Liquidium offers a unique cross-chain lending experience where users can deposit bitcoin and borrow assets like USDT on other chains.

- Interest rates in DeFi are algorithmically adjusted based on demand, and all loans are over-collateralized for safety.

What Is DeFi Lending?

DeFi lending, short for decentralized finance lending, is a peer-to-peer system where crypto holders lend their assets to borrowers without any centralized intermediaries.

On the other side, borrowers post crypto collateral to gain access to the assets in the lending pool. As with other DeFi operations, blockchain-based smart contracts handle transactions, ensuring transparency and reducing fees.

How Is DeFi Lending Different from CeFi Lending?

In DeFi lending, all borrowing and lending activities are managed by smart contracts on blockchain platforms, removing the need for traditional financial intermediaries like banks.

By contrast, lending in CeFi (centralized finance) functions more closely to traditional financial models, where banks or institutions act as facilitators, managing lending and borrowing processes.

How Does DeFi Lending Work?

The DeFi lending process relies on lending pools. Users who wish to offer their crypto for lending deposit a specific amount into these pools, which form a reserve of funds that borrowers can access.

Transactions are automated and secure, thanks to the smart contracts powering these pools.

The system allows lenders to contribute their assets to a shared pool, making them readily available for borrowers. In return, lenders earn interest on the assets they have deposited.

Liquidium vs. Aave vs. Compound: A DeFi Lending App Comparison

While Aave and Compound are both pioneers in DeFi lending, both are restricted to Ethereum and EVM-based blockchain ecosystems.

Liquidium, on the other hand, benefits from its cross-chain capability, which means users can deposit native BTC and borrow stablecoins on other chains without needing to bridge their BTC to another chain beforehand.

Its ICP-powered backend guarantees speed, decentralization, and a straightforward user experience.

How to Use Liquidium for Cross-Chain DeFi Lending & Borrowing, Step-by-Step

Using Liquidium for cross-chain lending and borrowing is surprisingly simple. Here’s a step-by-step overview:

How to Lend Crypto on Liquidium

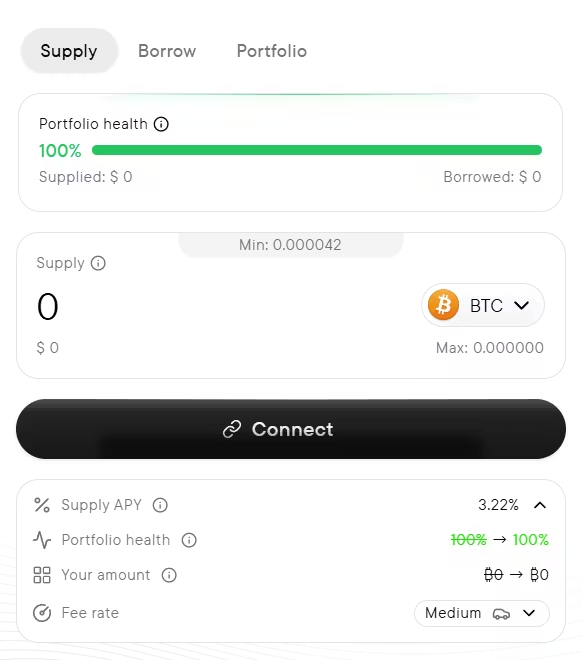

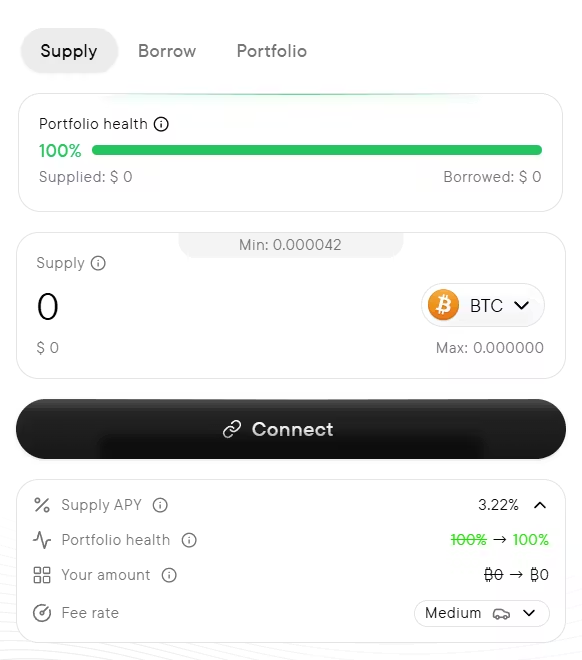

Visit liquidium.fi and connect your wallet.

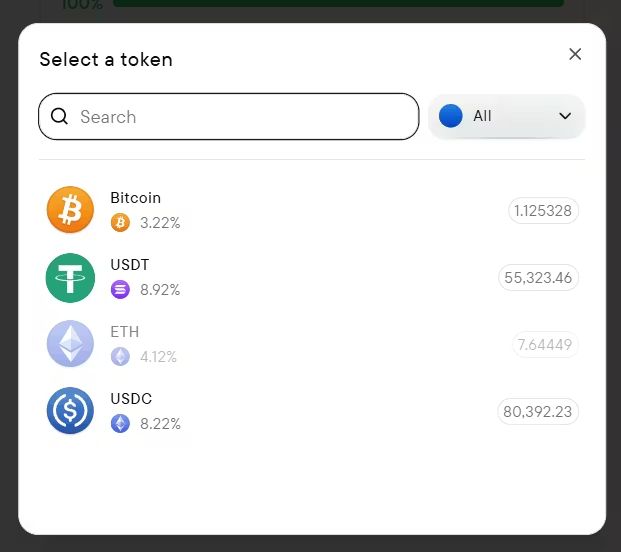

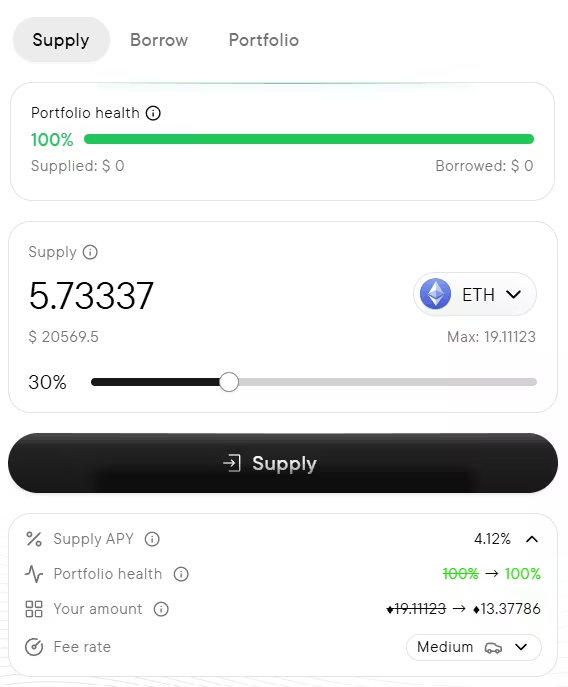

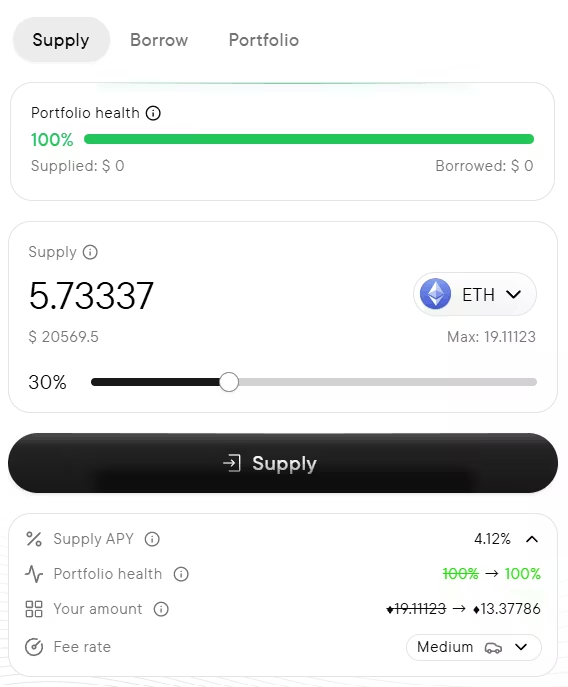

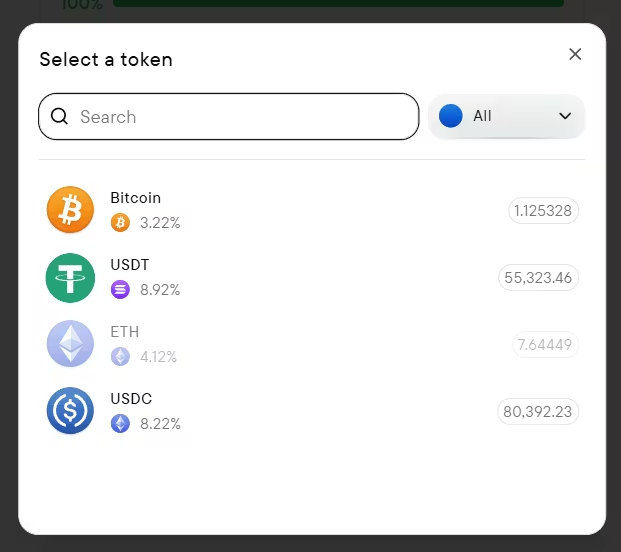

Under the ‘Supply’ tab, choose the assets you wish to lend (such as BTC, USDT, ETH, or USDC).

Click on the ‘Supply’ button and approve the transaction in your wallet.

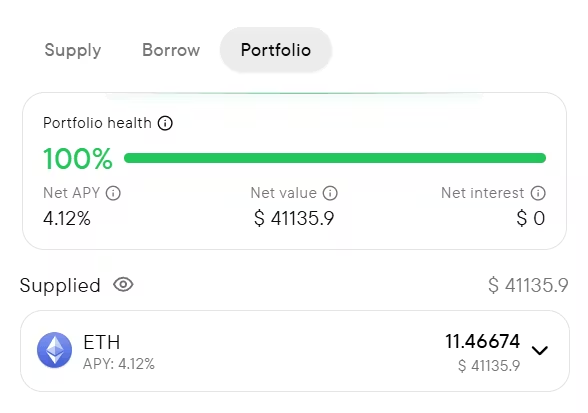

Start earning interest and monitor your portfolio from the dashboard.

How to Borrow Crypto on Liquidium

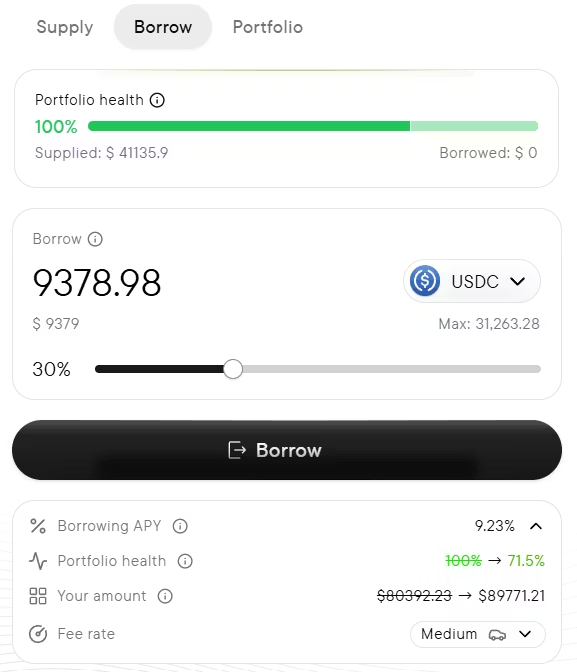

Connect your wallet on liquidium.fi.

Supply assets as collateral in order to borrow. The process is the same as "How to Lend Crypto on LiquidiumFi"

Choose a loan asset you wish to borrow.

Confirm and initiate the loan.

Users never have to touch a bridge or leave the interface.

“DeFi lending should be simple, secure, and work across chains.

With Liquidium, we’ve made it possible to unlock liquidity from Bitcoin and other L1 assets without complexity.” - Robin Obermaier, CEO & Co-Founder of Liquidium

Get Started With DeFi Lending on Liquidium

If you’re ready to earn interest on your digital assets, Liquidium makes DeFi lending simple, secure, and capital-efficient, free from bridges and complex setups.

Connect your wallet and start lending or borrowing with Liquidium

FAQs

What is the best DeFi lender?

There are many different DeFi lending platforms available. For instance, Aave and Compound are established but limited to the Ethereum ecosystem.

Meanwhile, Liquidium is ideal if you’re looking for cross-chain lending, Bitcoin-collateralized loans, or more efficient capital usage.

How are interest rates determined in DeFi lending platforms?

Interest rates in DeFi lending are determined by supply and demand dynamics.

These, as in the case of Liquidium, can be dynamic interest rate models, where rates shift based on pool utilization.

When demand for borrowing rises, rates go up. When it’s low, they drop. This adjustment happens automatically.