TL;DR

- Lending USDC allows you to earn interest by supplying stablecoins to borrowers through centralized or decentralized platforms.

- Liquidium enables non-custodial, cross-chain lending of USDC, powered by Internet Computer Protocol (ICP) and smart contracts.

- You can deposit USDC on Liquidium to earn yield from borrowers who post crypto collateral such as BTC and ETH.

What Is USDC?

USD Coin (USDC) is one of the most well-known stablecoins on the market. This price-stable digital currency is pegged to the US dollar at a 1:1 ratio, backed by dollars and near-cash dollar-denominated assets.

Primarily, USDC is used as trading capital, a base currency for trading pairs, and a lending asset, all thanks to its relative price stability.

How Does USDC Lending Work?

USDC lending includes three main participants; the lender providing USDC and earning interest, the borrower taking the loan in USDC and locking up their crypto assets as collateral, and the lending platform that connects the two sides, handles collateral, and automates the lending process.

Usually, it works like this:

- A lender supplies USDC to a lending pool.

- A borrower provides crypto collateral exceeding the loan value (overcollateralization).

- The borrower receives the USDC and their collateral is locked by a smart contract.

- The borrower repays the loan plus interest and the collateral is released back to them.

- Failure to repay the loan results in automatic liquidation and settlement of the loan.

Types of USDC Lending Platforms

There are two main types of USDC lending platforms: centralized and decentralized. Being fully aware of their differences is critical to making an informed choice.

Centralized Finance (CeFi) Platforms

Centralized lending platforms are apps created and managed by companies that custody your funds and manage the lending process, such as Binance Loans. Their perks mainly include a user-friendly interface and (usually) fixed rates.

That said, using a CeFi lending platform means trusting a centralized company with complete control of your funds. This comes with the risk of potential collapse, as seen in the cases of Celsius, FTX and other failed centralized crypto lenders.

Decentralized Finance (DeFi) Platforms

Decentralized finance lending apps are on-chain protocols like LiquidiumFi. Such platforms use smart contracts to automate the lending process.

Unlike CeFi, DeFi platforms give you complete control over your assets and provide transparent rates and mechanisms. They’re also widely accessible to anyone, anywhere, and at any time.

“Stablecoin lending adds to the core principles of decentralized finance. It empowers users with financial control without compromising their autonomy. We’re proud to say that Liquidium facilitates across multiple chains,” says Robin Obermaier, CEO & Co-Founder of Liquidium.

Benefits of Lending USDC

Lending USDC is very beneficial.

- Generate income on idle assets

- Access to high yields

- Large selection of available platforms

- Easy to implement into DeFi strategies

How to Lend USDC & Earn Yield on Liquidium: Step-by-Step

Now, let’s go through the process of lending USDC on Liquidium. Here’s what you have to do.

Visit Liquidium

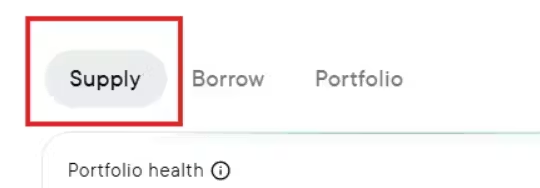

Open the liquidium.fi website and go to the ‘Supply’ tab.

Select the USDC market

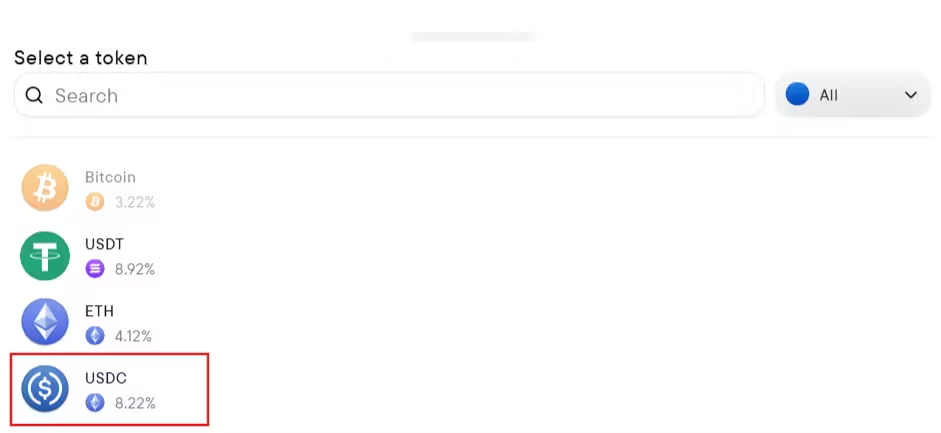

Choose USDC from the list of supported tokens.

Connect your wallet

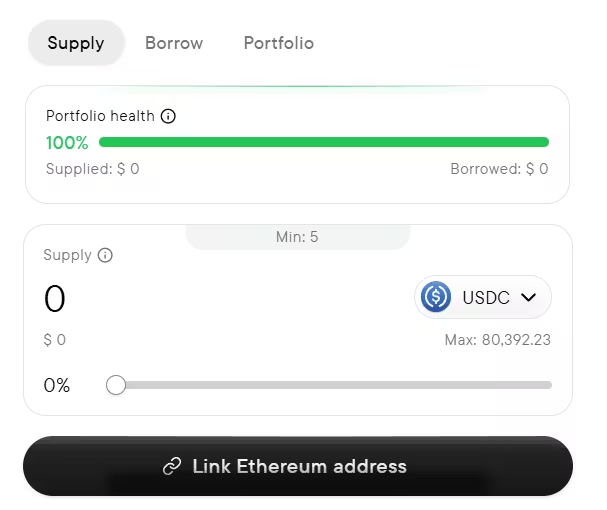

The platform will ask you to connect your wallet (like MetaMask).

Deposit USDC

Decide how much USDC you want to supply for lending, check the terms, and click on the ‘Supply’ button.

Verify the transaction in your wallet.

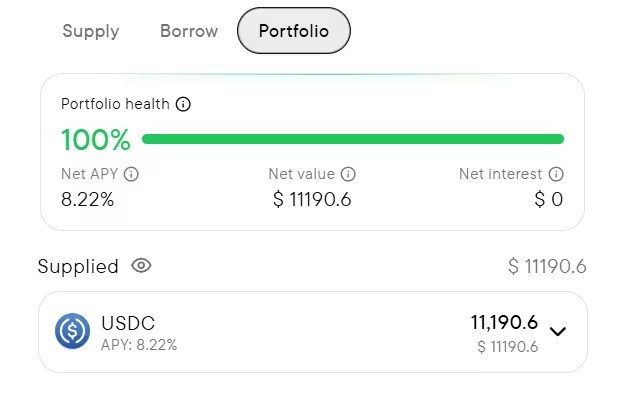

The deposit will then be initiated and completed, and you’ll be able to manage your loan under the ‘Portfolio’ tab in the Liquidium app.

What Makes Liquidium Stand Out for USDC Lending?

Though many platforms allow you to earn interest on stablecoins, Liquidium offers one of the most efficient and user-friendly USDC lending experiences in DeFi.

It does this by combining:

Cross-Chain Collateralization

As opposed to traditional DeFi lending platforms that operate within a single blockchain ecosystem, Liqudium works across multiple networks.

It allows users to deposit assets like BTC or ETH as collateral on one chain and borrow USDC on another, without requiring manual bridging.

This provides borrowers with more flexibility and opens up greater lending demand and opportunities for USDC lenders.

ICP-Powered Efficiency

Liquidium’s platform runs on the Internet Computer Protocol (ICP).All backend logic, including rate adjustments, oracle price checks, and liquidation, is executed via smart contracts on ICP.

This means faster transactions and liquidations, unified backend with chain-key bridging (ckUSDC, ckBTC, etc.), no blockchain rollbacks or inconsistencies, and users having zero exposure to the backend.

Liquidation Engine and Risk Protection

Liquidium uses an automated loan-to-value (LTV) engine to protect against risks of bad debts.

If a borrower’s LTV ratio approaches dangerous levels due to market movement or interest buildup, their collateral is automatically liquidated.

Universal Asset Collateral

With Liquidium, borrowers can use any major Layer 1 crypto (BTC, ETH, etc.) as collateral on any supported chain.

This cross-chain design expands borrower demand and increases the opportunities for USDC lenders to earn competitive returns.

Lend Your USDC & Earn Yield on Liquidium

Supplying your USDC for lending is one of the best and easiest ways to grow your digital asset portfolio.

As a non-custodial, cross-chain lending protocol, Liquidium makes this easy, secure, and transparent.

Connect your wallet on liquidium.fi. With just a few clicks, start earning yield on USDC.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice.

Always do your own research (DYOR) before making any financial decisions.

FAQs

What is the lending rate of USDC?

Rates vary depending on the supply and demand in the USDC pool.

On Liquidium, rates are not fixed but dynamically adjusted based on how much USDC is currently borrowed vs. supplied to optimize utilization, so check the live rate on the platform.

Is lending USDC safe?

As with any other financial operation, lending always carries risk; however, it can be relatively safe when conducted through a reputable, decentralized platform.

Liquidium mitigates the risks with smart contracts, overcollateralized loans, and a liquidation engine that protects lenders.

Where can I lend USDC?

You can lend USDC by depositing it either on a centralized lending platform like Binance Loans or a decentralized one, such as Liquidium.

The precise procedure of lending USDC varies from one platform to the other, but payouts usually arrive on a daily basis.

Where can I get the best USDC lending rates?

The best USDC lending rates vary across platforms and over time, but dynamic DeFi lending pools, such as those offered by Liquidium, provide some of the most competitive yields, especially when demand for USDC loans is high.

Rates on Liquidium adjust automatically based on supply and demand, so when borrowing demand increases, the interest rates for lenders rise, providing higher yield opportunities.

What is the difference between USDC lending and staking?

The main difference between lending and staking is that lending USDC earns interest from borrowers, whereas staking typically involves reaping rewards from network participation.

Plus, lending is ideal for stablecoins like USDC if you want a way to earn relatively stable interest.

Meanwhile, staking cryptocurrencies (such as ETH and SOL) requires taking into account market volatility.

Additionally, staking may include lock-up periods, and there’s a risk of staking rewards dropping.