TL;DR

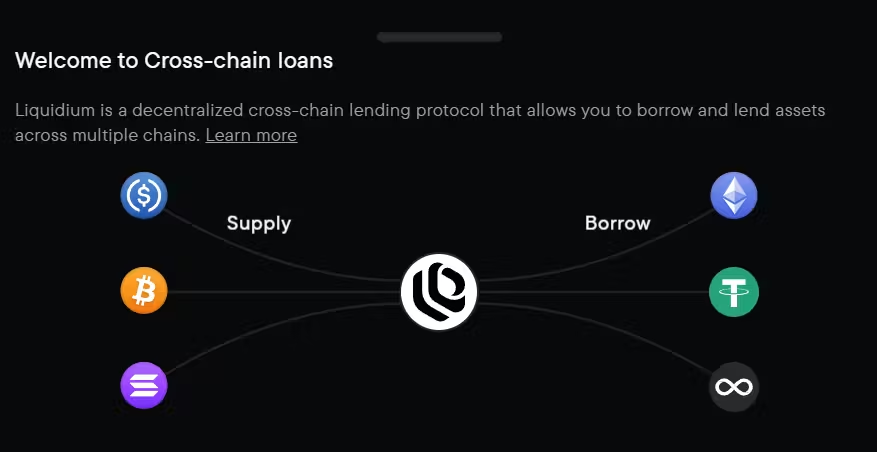

- Stablecoins don’t earn interest by default, but you can put them to work through DeFi lending platforms like Liquidium.

- Liquidium lets you earn interest on stablecoins like USDT and USDC by supplying them to borrowers across chains.

What Are Stablecoins?

A stablecoin is a price-stable digital currency operating on a blockchain that’s pegged to the value of traditional assets, such as the US dollar.

For example, the largest stablecoin by market capitalization, Tether USD (USDT), is backed 1:1 with US dollars and near-cash dollar-dominated securities, to make sure its value is always equal to US$1 and can be redeemed for that amount.

Stablecoins come with the advantages of crypto, like fast and borderless transactions, but without the price volatility. Besides USDT, other notable stablecoins include USD Coin (USDC), Dai (DAI), and True USD (TUSD).

Do Stablecoins Pay Interest?

No, stablecoins don’t pay interest natively when you’re just holding them in your crypto wallet, like the money held in your bank account does.

However, stablecoins do pay interest if you lend them to other market participants who want access to more liquidity.

If you want your stablecoins to work for you (i.e., pay you interest), you will need to take advantage of DeFi lending platforms like Liquidium, which have been built to make that possible.

How Can You Earn Interest on Your Stablecoin?

There are several methods you can use to earn interest or yield on your idle stablecoins. The following are the most notable:

Lending protocols

Through decentralized lending protocols like Liquidium, you can supply your stablecoins to a pool from which others can borrow. In return, you earn interest from the borrowers. In the entire process, you retain control of your funds through the collateral the borrowers provide.

Lending is one of the simplest and safest ways in the DeFi ecosystem that you can use to generate passive income from your stablecoins.

Yield farming

Yield farming refers to depositing your stablecoins, commonly combined with another token, into liquidity pools on exchanges. In return, you earn fees and liquidity provider (LP) rewards, sometimes in native tokens. Though potentially more lucrative, yield farming is complex and carries additional risks like impermanent loss that tend to make it a riskier venture than lending, for example.

CeFi platforms

Centralized finance (CeFi) platforms like centralized crypto exchanges may offer stablecoin interest, too, typically in the form of ‘Earn’ or ‘Savings’ products.

However, these require you to give up custody over your assets and trust a third party. This makes transparency and risk assessment more difficult than is the case with DeFi protocols.

Step-by-Step: How to Earn Interest on Stablecoins Using Liquidium

Here’s how to start earning interest on your stablecoins using Liquidium:

Visit Liquidium

Visit Liquidium’s official website at https://liquidium.fi.

Connect Your Wallet

Click on the ‘Connect’ button and choose your preferred wallet. Liquidium supports multiple wallets.

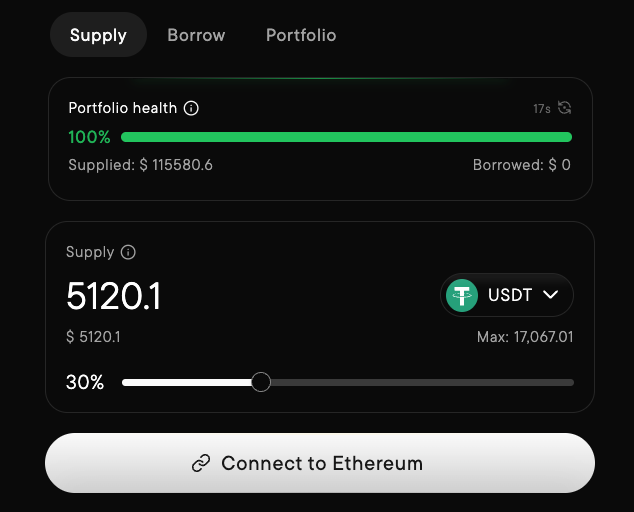

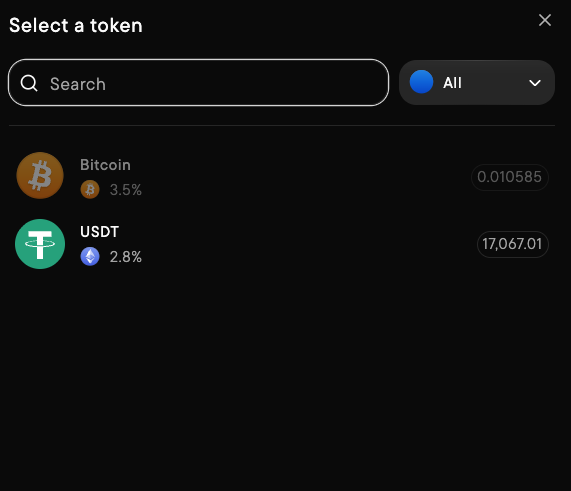

Deposit Your Stablecoins

Under the ‘Supply’ tab, choose your preferred stablecoin (e.g., USDT or USDC), select the amount you want to lend, click on the ‘Supply’ button, and approve the transaction.

Your assets are now supplied to the lending pool and made available to borrowers.

Start Earning Interest

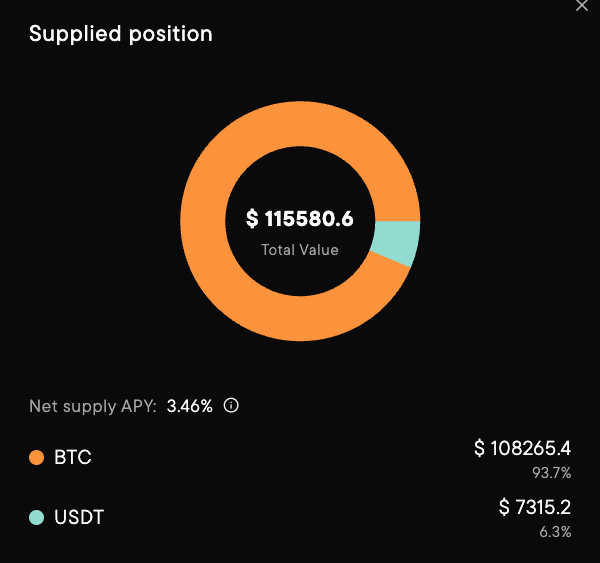

As borrowers draw from the resources supplied by lenders, you’ll earn yield.

Liquidium uses a self-balancing dynamic interest rate model based on supply and demand, and the process is entirely transparent via on-chain data.

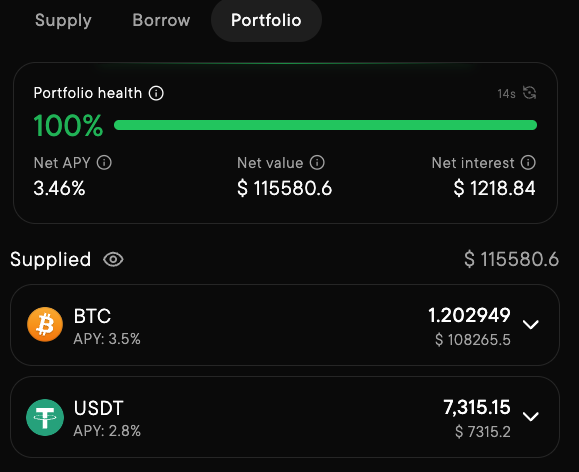

You can view your earnings, total loan volume, and platform stats right from your dashboard.

Manage Your Portfolio

You can withdraw your funds anytime or reinvest your earnings.

The intuitive user interface makes tracking your balance and interest effortless, even for beginners.

“We designed Liquidium to make it effortless and secure for anyone to earn interest on their assets, including stablecoins, notwithstanding the chain they’re on.

It's passive income, powered by decentralization,” explains Robin Obermaier, Co-Founder and CEO at Liquidium.

Benefits of Lending Your Stablecoins on Liquidium

Lending on Liquidium is arguably one of the best ways to earn interest on stablecoins.

The platform is designed to be secure and user-friendly.

- Yield generation: Earn yield on your digital assets.

- User-friendly: Simple steps and a clean interface that make onboarding and using the platform easy.

- Cross-chain demand: Borrowers across Ethereum, Solana, and multiple other chains can access liquidity and increase stablecoin lending opportunities.

- Security: Liquidium is secure and fully non-custodial, with smart contracts powered by Chain Fusion and anchored to Bitcoin Layer 1.

Lend Your Stablecoin & Earn Interest on Liquidium

If you’re looking for the best place to earn interest on stablecoins, you’ve found what you’re looking for with Liquidium.

With its unique cross-chain lending capabilities, institutional-grade security, and growing community of borrowers and lenders, the platform makes stablecoin lending easily accessible and rewarding.

Securely and effortlessly put your stablecoins to work and start earning interest with Liquidium.

FAQs

Can you make money on stablecoins?

Yes. You can make money on stablecoins by depositing them on lending platforms. When you lend your stablecoins to borrowers via DeFi protocols like Liquidium, you can earn interest, turning your idle assets into a steady stream of passive income.

Can you earn interest on your USD stablecoins using certain dapps?

Yes, you can. Several decentralized applications (dApps), including Liquidium, allow you to lend your USD stablecoins like USDT or USDC to borrowers across different chains. These dApps facilitate peer-to-peer lending in a transparent and automated manner using smart contracts, and this lets you earn interest as you maintain control over your funds.

Where is the best place to earn interest on USDT?

The best place to earn interest on USDT depends on your priorities, particularly in terms of security, yield, and ease of use. Liquidium stands out as a top choice. Thanks to its transparent lending system, non-custodial design, cross-chain support, and simple user interface, stablecoin holders can earn interest with minimal friction and maximum transparency.

How to make passive income from stablecoins?

The most common way to make passive income from stablecoins is through DeFi lending, where you deposit your stablecoins into a lending pool. Platforms like Liquidium connect your stablecoin capital with borrowers, and you generate interest in return. This strategy is particularly popular among users seeking low-volatility income without selling their assets.

What's the best way to invest in stablecoins?

Stablecoins aren’t typically used for speculative investment, as their value is pegged to traditional assets, such as the US dollar. However, you can invest in stablecoins by deposting them in DeFi lending protocols like Liquidium, where you can earn interest on the stablecoins you lend to other market participants.