BRC-20 Lending: How to Borrow & Lend BTC Using BRC-20 Collateral

Jan 21, 2025

Lending and borrowing BTC against Bitcoin-native assets, such as BRC-20 tokens, provides a great opportunity for you to earn yield on your bitcoin or access bitcoin liquidity.

Thanks to Liquidium, you can lend bitcoin (with BRC-20 provided as collateral by the borrower) and earn up to 380% APY. What’s more, you can use your BRC-20 tokens as collateral to borrow BTC, which you can then deploy in the Bitcoin DeFi market or use in any way you like without having to sell any assets to access the BTC.

Read on to learn everything you need to know about how to lend or borrow BTC using BRC-20 as lending collateral on Liquidium.

What Is BRC-20 Lending?

BRC-20 lending refers to loaning out your bitcoin (BTC) to a borrower who provides their BRC-20 tokens as collateral for the BTC loan.

Once the debt is repaid, you’ll receive interest paid in BTC (up to 380% APY on Liquidium) and your deposited BTC back. In some cases, loans can default, but you won’t be left empty-handed because the BRC-20 collateral, initially worth more than the BTC you lent, will be ready for you to unlock on the platform, so it can then be sent to your wallet directly.

By collateralizing the BTC loan with BRC-20 tokens, the borrower can access bitcoin without having to sell any assets to acquire BTC. At the same time, your risk as the lender is reduced because, in the case of default, you gain access to the collateral and can sell it to cover your losses.

How to Lend Against BRC-20

The good news is that lending your BTC against BRC-20 on Liquidium is really straightforward and secure. Here’s how it works:

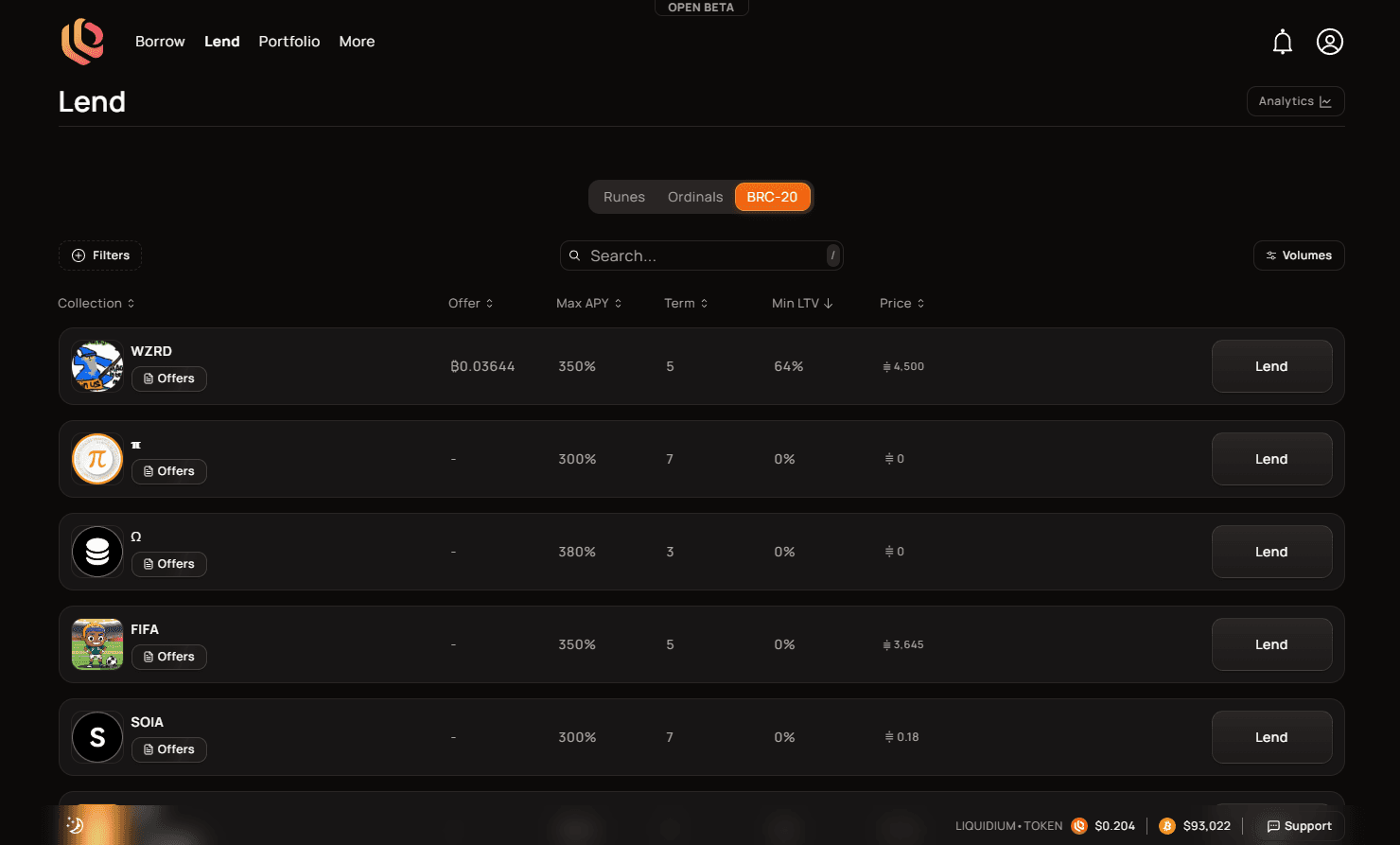

Access the Liquidum lending dashboard

Go to app.liquidium.fi and click on the ‘Lend’ tab in the top left of the app’s dashboard.

Pick the BRC-20 token you want to lend against

You can find one on the list in the app or use the search bar to find a specific token. You can also rank them by by loan offers, max APY, price, etc.

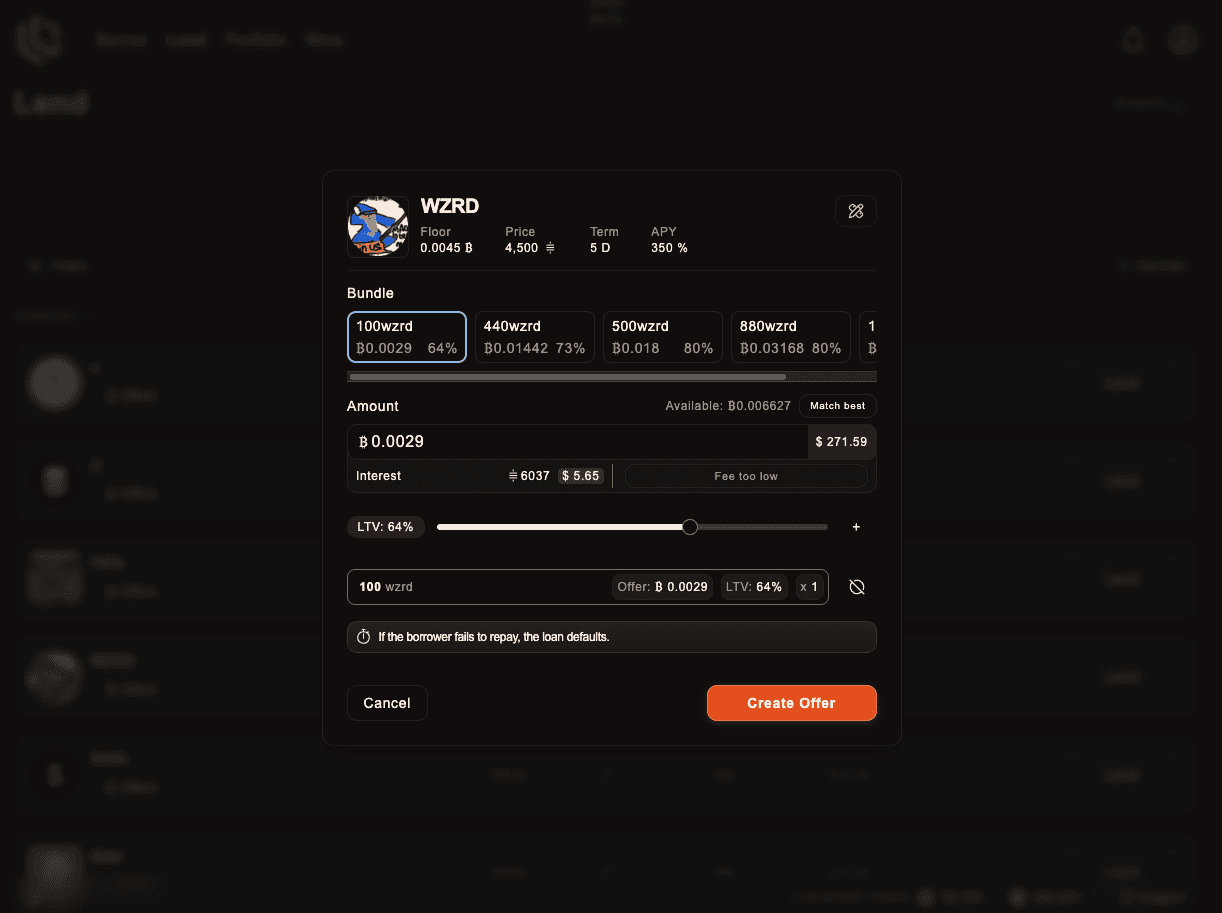

Set a lending amount

Once you’ve chosen the token you want to lend against, you need to set a lending amount.

The minimum lending amount for BRC-20 is 0.001 BTC. Click on a bundle you’re interested in and create an offer.

The LTV is matched by default, but if you are able or willing to provide more liquidity, you can. That will also increase the chances of your loan getting accepted.

Pick an LTV and create your offer

The suggested Loan-to-Value (LTV) ratio will be automatically set (in our example, it’s 64%), but Liquidium allows you to set it anywhere between 0% and 100%. You just need to use the sliding bar to choose your own.

Higher LTVs mean higher interest, which might be better for the lender, but it also comes with a greater risk.

When you move the sliding bar, all the fields update automatically. The app will tell you the new lending amount, interest, and total offer. You’ll also be notified if the amount is below the minimum lending amount.

Create your offer

Once you’ve chosen terms and are happy to lend out your BTC, click on ‘Create Offer.’

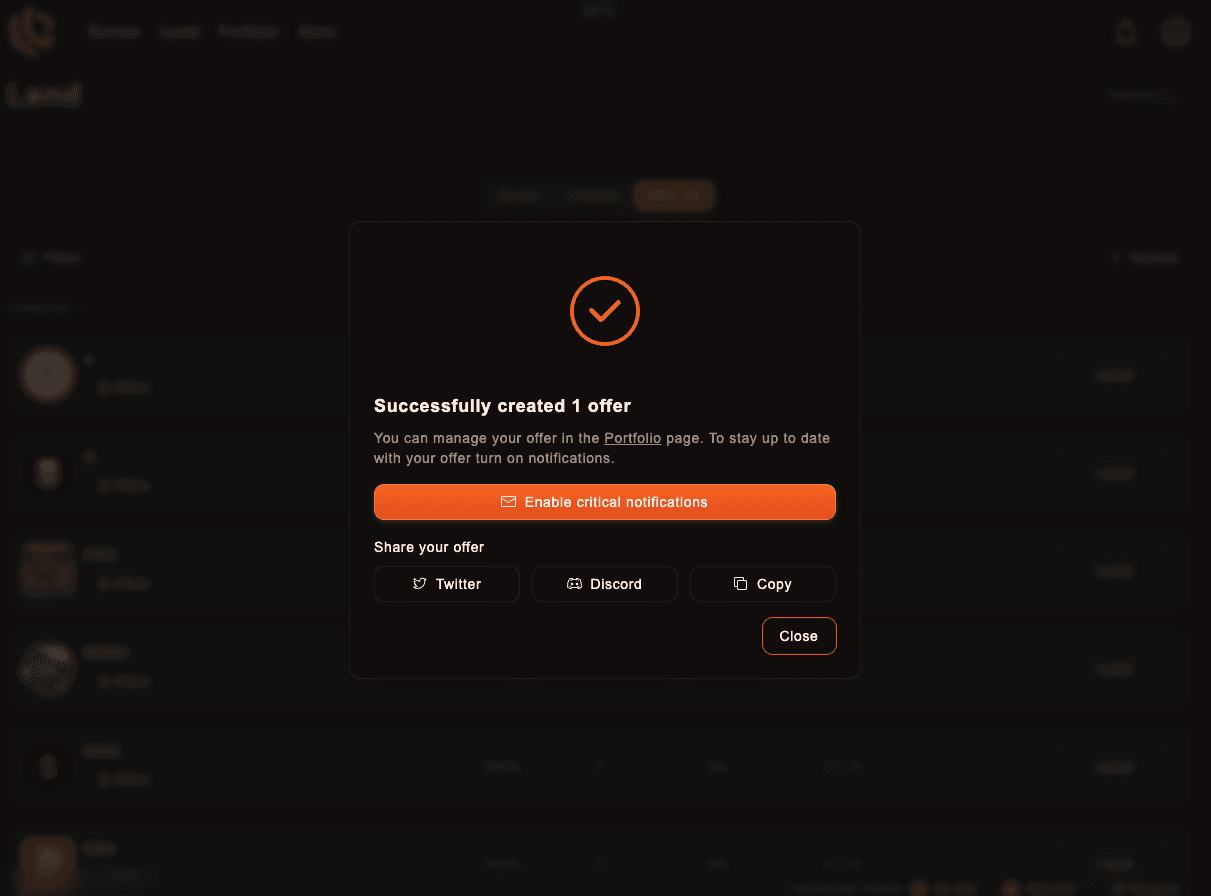

Wait for a borrower

Once you’ve successfully created your offer, the rest is a waiting game. You can view your loan offer under the ‘Portfolio’ tab.

The time it takes until your offer is accepted will depend on the terms you’ve set, borrower interest, and sometimes even luck. Either way, Liquidium will notify you via the app, as well as Telegram and/or email, according to your settings.

Approve the loan

Once a borrower comes through, all you have to do is to approve the loan (if you still agree with the terms, of course).

Open your ‘Portfolio’ dashboard, find the offer under ‘Pending,’ then confirm the loan and sign the transaction using your wallet. The transaction needs to be confirmed in the mempool before the loan starts.

And voila! You’ve lent BTC against BRC-20.

How to Borrow Against BRC-20

Borrowing BTC on Liquidium is as easy as lending, you just approach the process from the other side. Here are the steps:

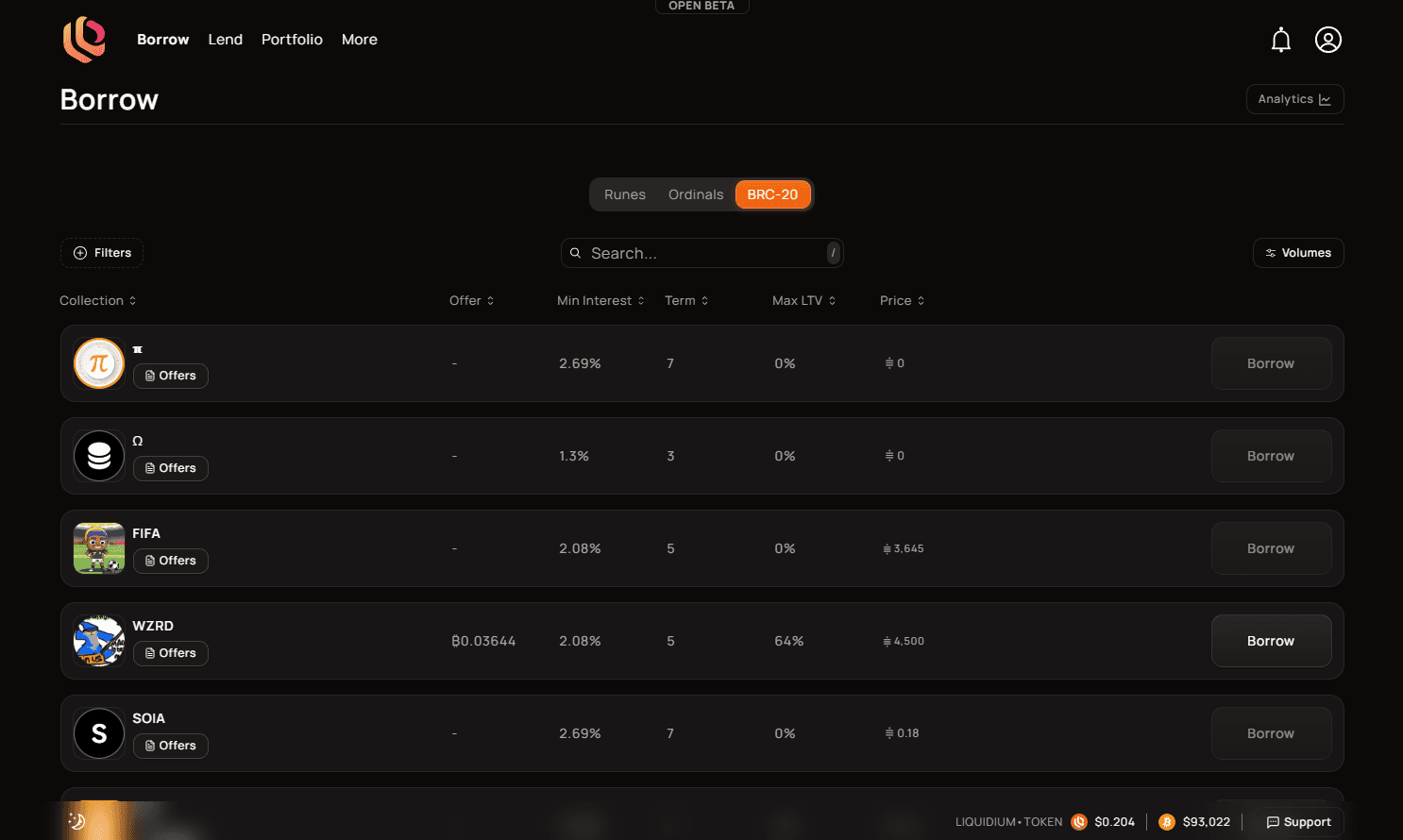

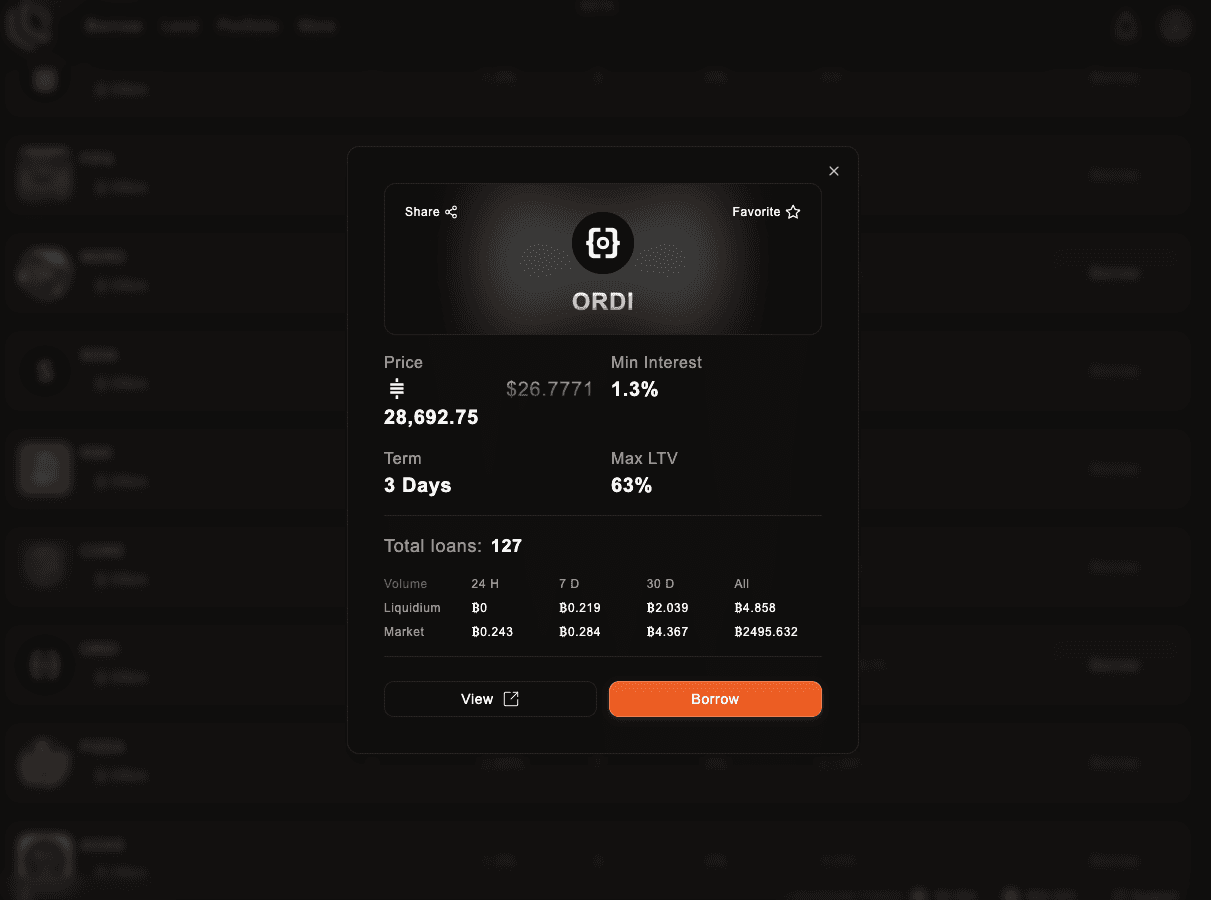

Choose a BRC-20 to borrow against

Make sure you’re starting from the ‘Borrow’ tab at the top left of the app. Then, click on the ‘BRC-20’ tab to list the available tokens, and find one you own and want to borrow against.

You can use the search bar to find one as well.

Pick the BRC-20 to use as collateral

The BRC-20 you own is the collateral you’re using. You’ll be shown different batches and feel free to choose the one with the best terms for your needs.

Under the asset’s name, you’ll see the amount offered, interest percentage, LTV percentage, and the term, which is the time by which you need to repay the loan.

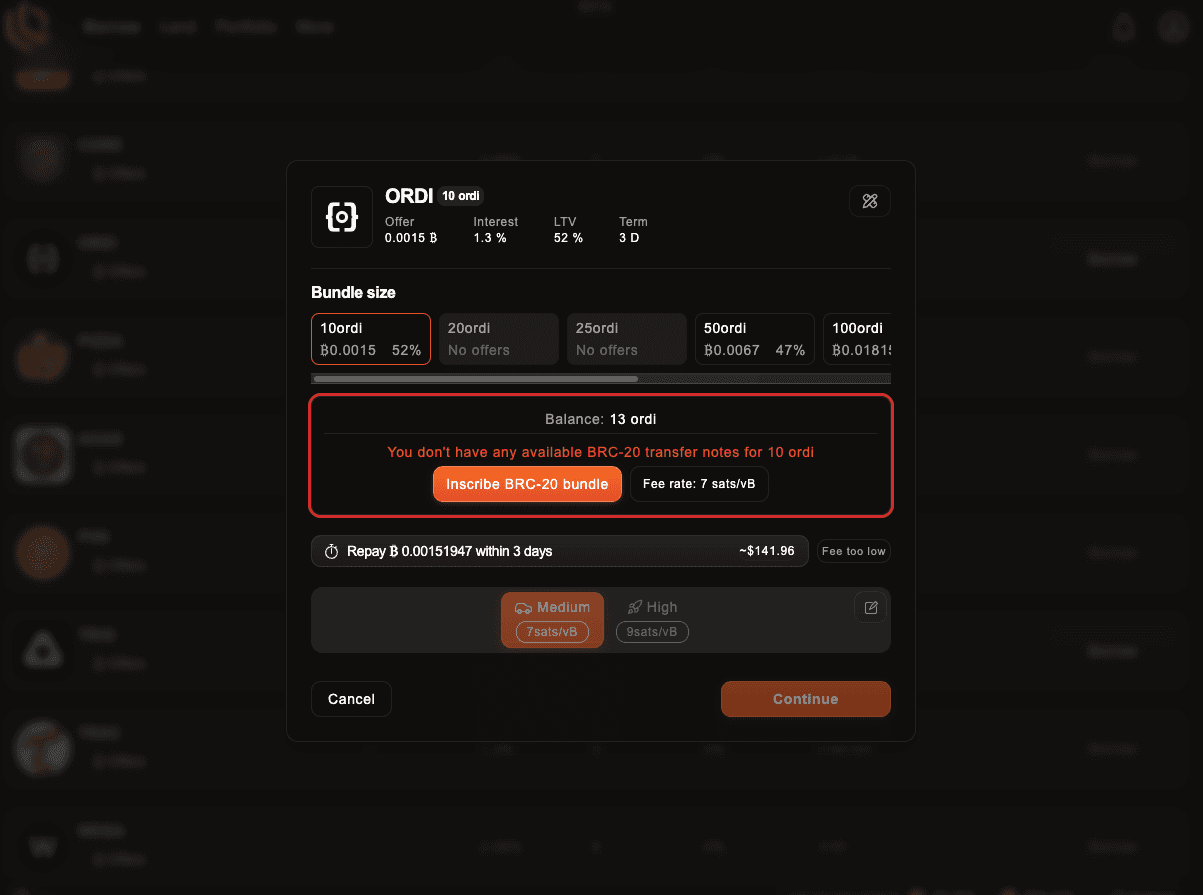

Choose a bundle

Choose a bundle and make sure you are happy with the borrowing terms.

Create a transfer inscription

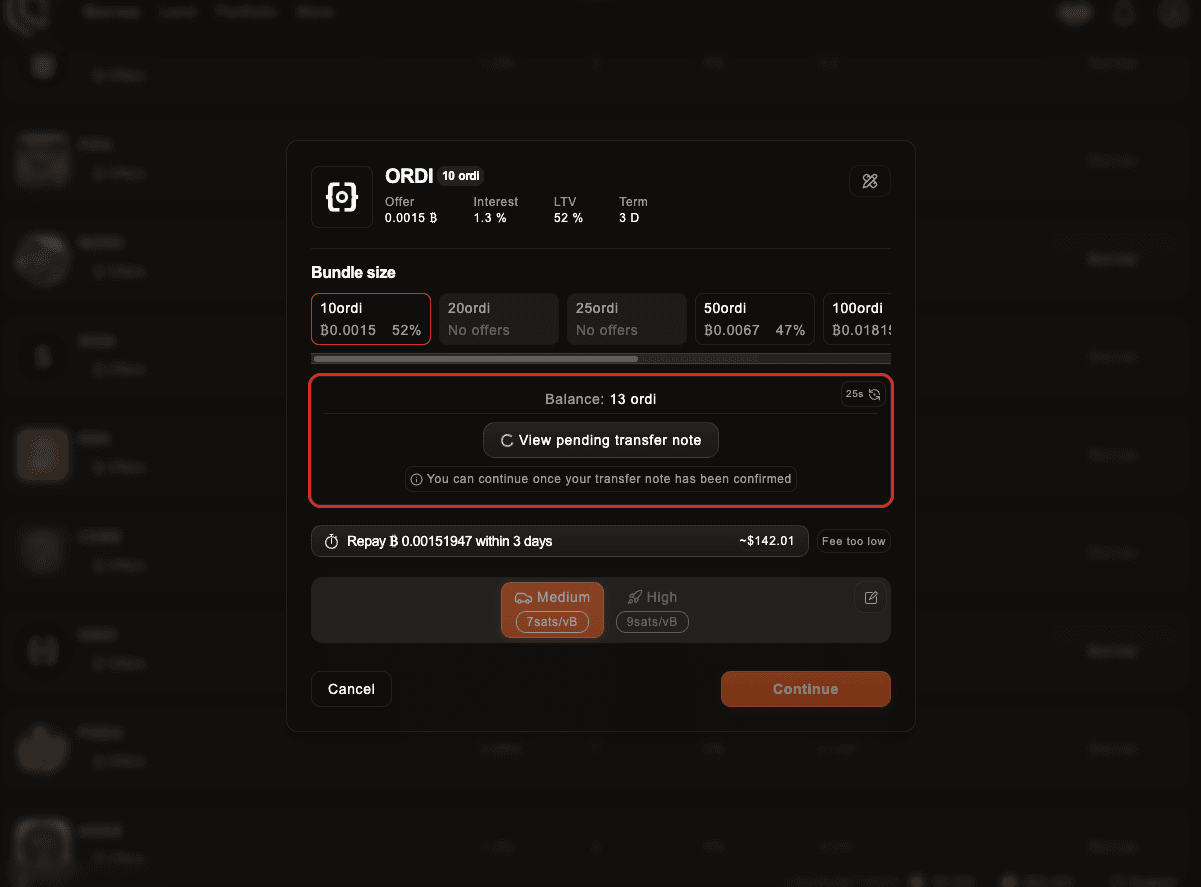

If you don’t have a transfer inscription for the bundle you’ve chosen, you’ll get the option to ‘Inscribe Transfer’ in the ‘Borrow’ window.

If you can’t see this option, no worries, you’re good. But if it does appear, all you need to do is click on ‘Inscribe BRC-20 bundle’ to get the right bundle size for your loan.

Pick a transaction speed

You can customize the transaction speed, which will affect how much you’ll need to pay for this transaction. Slower transactions mean lower fees, but you’ll have to wait longer than if you’d paid more to get higher speeds.

You can choose between the ‘Medium’ and ‘High’ preset options, or click the pencil in the upper right corner of that tab to set your own fee.

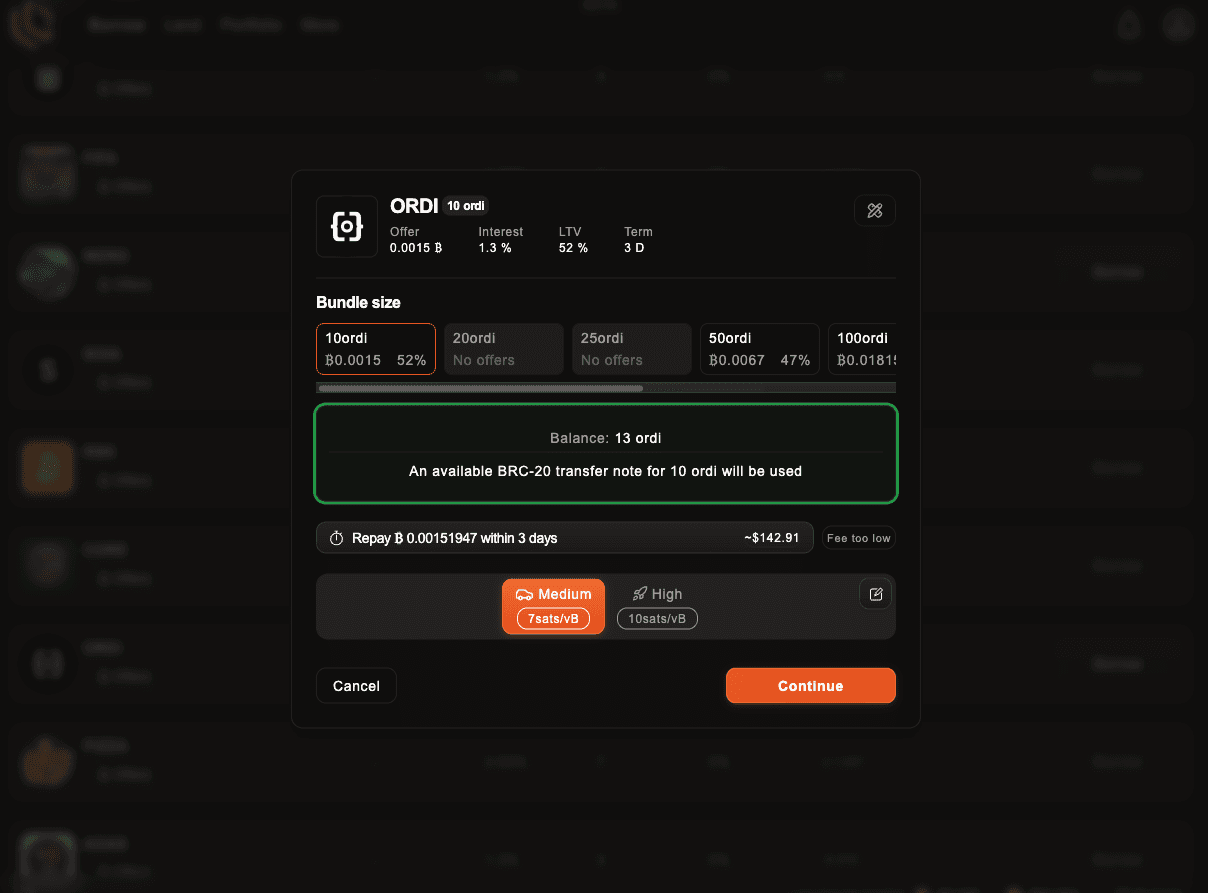

Confirm to accept the loan offer

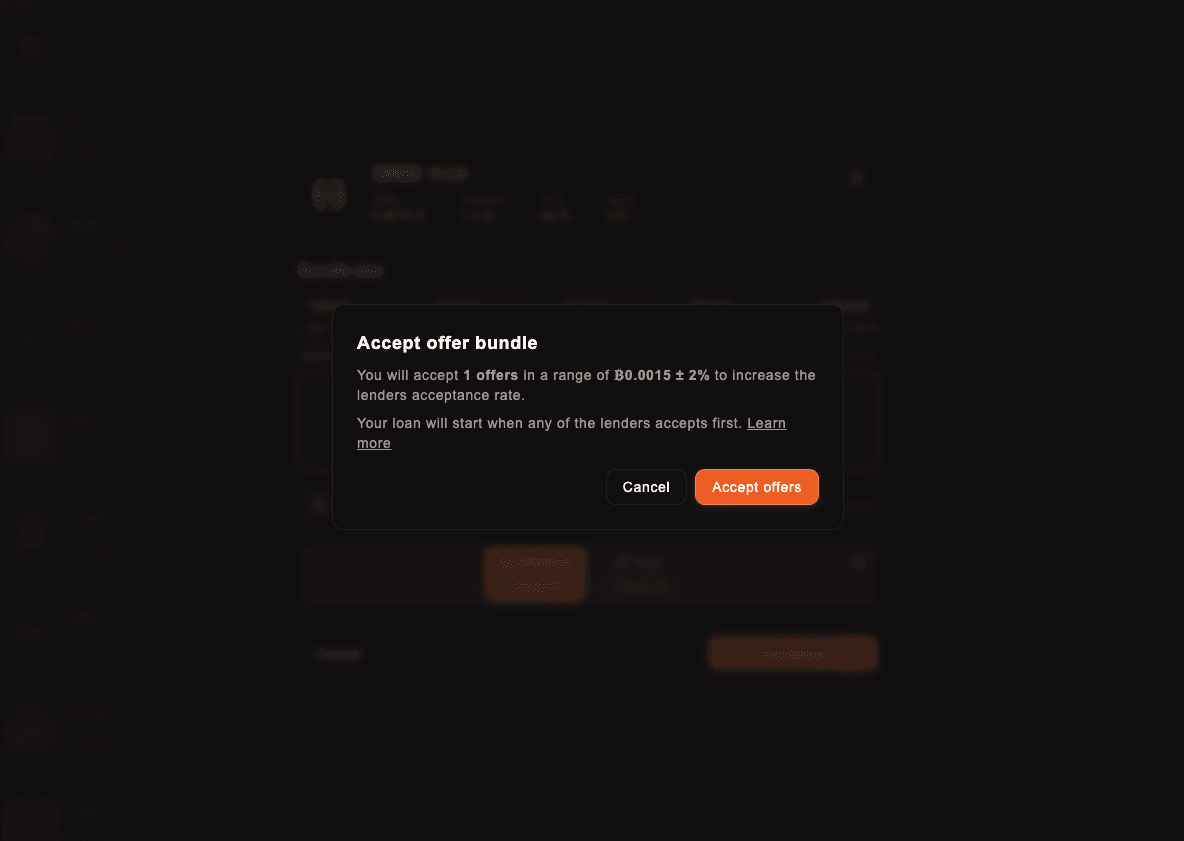

When you click on ‘Continue,’ you’ll get the chance to take another look at the terms of the bundle you’ve chosen.

If there’s more than one offer within a 2% range of the loan amount, you can freely accept whichever offer is signed first. Otherwise, you’ll just accept the standalone best offer.

Click on ‘Confirm’ in your wallet to accept it.

Wait for the lender’s approval

Since the lender needs to sign and broadcast the transaction manually, be patient, as you’ll have to wait for them to approve it. The app will notify the lender via the channels they’ve chosen.

This is completely up to the lender. Liquidium can’t speed up the process. If it takes too long, you can cancel the loan anytime and find a different one. It’s a free market, after all!

Once the loan is approved, you’ll receive your borrowed BTC once the transaction is confirmed on-chain.

Explore Liquidium to Use BRC-20 as Bitcoin Lending Collateral

Bitcoin lending platform Liquidium is your go-to place to borrow bitcoin using BRC-20 tokens as collateral or lend your BTC against them to earn interest.

To get started, all you need to do is to connect to your Bitcoin Web3 wallet to the Liquidium app and check out the lending collateral options available.

Connect your wallet to Liquidium to start borrowing and lending BTC against BRC-20 collateral today.

Disclaimer: This article does not constitute financial advice, and we strongly recommend conducting your own research and consulting with a professional financial advisor before making any investment decisions. We are not liable for any potential losses incurred from applying the strategies discussed. Proceed with caution and at your own risk.